Statistics indicate that inpatient admissions and revenues are falling nationally, a development that affects clinical laboratories in hospitals and health systems

One important trend that directly impacts the medical laboratories of hospitals and health systems is the falling rate of inpatient registrations seen nationally in recent years. What exacerbates this trend is the fact that many payers are cutting the prices they pay for certain inpatient services.

Collectively, these two developments mean less inpatient revenue for many hospitals and that often translates into reduced budgets for the clinical laboratories.

But that is not the whole story concerning inpatient revenue. Spurred by the Affordable Care Act (ACA) and other market developments, payers now want to shift reimbursement away from fee-for-service to new models of reimbursement. This includes capitation or bundled payment models.

There are multiple reasons why hospital use rates are declining in many areas of the nation, noted a report published by healthcareaffairs.org. One factor appears to be a correlation between the level and pace of the regional market’s shift toward value-based medicine—particularly through establishment of accountable-care organizations (ACOs)—and the level and pace of declines in hospital inpatient utilization.

Decline in Hospital Utilization Spells Rise in Primary Care Visits

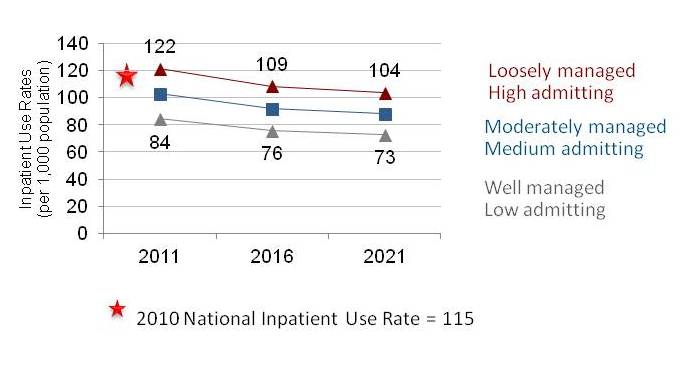

Milliman, an actuarial firm with claims data for about half of the nation’s commercial insurers, predicted that inpatient admissions per 1,000 patients will decline through 2021 in all markets. This will be true whether care is “loosely,” “moderately,” or “well” managed.

More specifically, Milliman projects that inpatient admissions per 1,000 will drop from 103 in 2012 to 88 by 2021. Milliman based its analysis on a 2011 multi-state study of declining inpatient utilization that was done by Kaufman, Hall & Associates, Inc..

In its study of falling inpatient admissions, Milliman estimated that, in all markets of the United States, the rate of inpatient admission per 1,000 population would decline through 2021. This would be true whether, in a specific market, care could be defined as “loosely,” “moderately,” or “well” managed. The chart above shows the 10-year trend line. (Chart was published by Health Affairs Blog.)

Statistics from the Medicare program provide additional evidence that inpatient volumes are declining. In its “Report to the Congress on Medicare Payment Policy–March 2012,” MedPac wrote: “The shift away from the inpatient setting is reflected in declining inpatient occupancy rates and a decline in the share of beneficiaries using inpatient services. From 2004 to 2010, the overall hospital bed occupancy rate declined 2 percentage points, from approximately 68% to 66%. In addition, the share of Medicare FFS beneficiaries using inpatient hospital services declined 2 percentage points, from 22% to 20% from 2006 to 2010. Similarly, from 2006 to 2010, the number of Medicare inpatient bed days per beneficiary declined from 1.9 in 2006 to 1.7 bed days per beneficiary in 2010.”

These statistics are interpreted by some healthcare experts as confirming that the end of the hospital-centric care model is approaching. As that happens, the role of hospitals in care delivery systems will shift from solely acute care diagnostic and treatment activities toward delivering value-based quality care—doing the right thing for the patient at the right time, stressed the healthcareaffairs.org report. This will require eliminating unnecessary clinical and testing activities, as well as educating patients and family members about preventive health activities and incentivizing physician participation in value-based care.

Moreover, the success of hospitals in the value-care arena will require a strong, organized physician platform, along with exceptional communication and health information technology (HIT) infrastructure and capabilities.

Certainly there are some hospitals and some regions of the nation where inpatient volumes remain constant or may even be increasing. But it is important for clinical laboratory administrators to understand the national trends. The statistics presented above explain why so many hospitals and health systems are cutting costs and shrinking the budgets for clinical service lines, including their medical laboratories.

—by Patricia Kirk

Related Information:

Decline in Utilization Rates Signals A Change In The Inpatient Business Model

Mayo Clinic’s cure for an ailing medical system

MedPac: Report to the Congress on Medicare Payment Policy–March 2012