Now in its fifth year, Indiana’s CDHP now covers 90% of eligible state employees

Many pathologists and clinical laboratory managers are carefully watching for evidence that new healthcare delivery models can deliver improved patient outcomes at a lower cost. Now comes evidence that a consumer-directed health plan (CDHP) for Indiana state employees—that incentivizes consumers to manage their healthcare dollars more carefully—is saving money for both employees and the state.

According to a story in the Centre Daily Times (CDT), state officials in Indiana claim that the state’s CDHP has reduced the state’s overall health benefit costs and met with high subscriber satisfaction.

Governor Mitch Daniels and other Indiana officials claim that, since introducing the CDHP in 2006, the Hoosier state’s overall health benefit costs are down by more than 10%, with only 2% of subscribers switching back to a traditional plan, the CDT reporter wrote.

Current Health Plans Encourage Overconsumption and Overspending

In a commentary published by The Wall Street Journal, Daniels decried today’s healthcare system as conducive to overconsumption and overspending. “The prevalent model of health plans in this country signals individuals they can buy health care on someone else’s credit card,” he stated. “[With a CDHP, state employees] will think twice about paying for the same diagnostic test a second time or going to the emergency room on the weekend for convenience,” Daniels stated.

Wikipedia describes a CDHP as a plan in which members use health savings accounts (HSA), health reimbursement accounts (HRA), or similar medical payment products to pay routine healthcare expenses. A high-deductible health plan then provides coverage against catastrophic medical expenses.

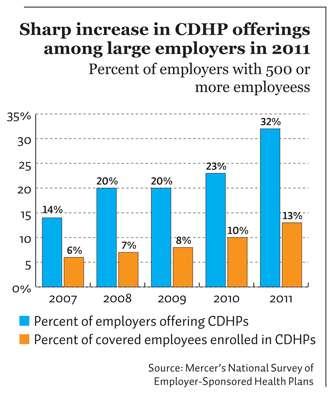

With each successive year, the number of employers offering a consumer-directed health plan (CDHP) increases. The national media has not paid much attention to this trend. Mercer produced this chart as part of its National Survey of Employer-Sponsored Health Plans.

Indiana’s CDHP provides free preventive care and the employee pays no monthly premiums. To encourage participation, the state contributes 60% of the plan’s $5,000 annual deductible through a deposit into the employee-owned HSA on January 1, the Centre Daily wrote. Experts claim short-term savings on consumer-directed plans will likely more than cover these HSA investments.

Like other states, Indiana’s employees were slow to adopt the plan at first. Only 4% signed up the first year. However, through word-of-mouth and an intensive education initiative, the program achieved 30% participation by the third year and has grown steadily. Starting this year, 90% of Indiana state workers will be covered by the state’s CDHP, CDT stated.

A 2010 analysis by the Mercer consulting firm showed that Indiana employees on the CDHP were changing the way they made healthcare purchasing decisions. “[W]e are seeing significant changes in behavior, and consequently lower total costs,” stated Daniels in the WSJ commentary. Compared to co-workers in Indiana with traditional health care, HSA participants:

- Visited emergency rooms and physicians 67% less frequently.

- Were much more likely to use generic drugs.

- Were admitted to hospitals less than half as frequently.

“[W]hen someone is spending his own money alone for routine expenses, he is far more likely to ask the questions he would ask if purchasing any other good or service,” Daniels noted.

The governor projected 2010 savings for the state at $20 million, based on high HSA enrollment. Mercer estimated that the option is reducing total healthcare costs for the State of Indiana by 11%.

CDHP Enrollment Is Changing Financial Terms for Traditional Health Plans

Growing employee participation in Indiana’s CDHP is putting pressure on its traditional health plan option. Because the traditional health plan’s insurance pool is shrinking, premiums are soaring. For example, in 2006, an Indiana employee’s annual premium for family coverage in the traditional plan was $3,500. Within three years that number had jumped to nearly $5,000, CDT stated. In 2010, the annual premium further increased to more than $9,000.

Experts say that Indiana’s traditional plan is close to a “death spiral,” the story stated. This is due to what is known as “adverse selection” that results when fewer healthy people remain to cover the costs for those who have high medical bills. The cost of covering a small pool of subscribers rises beyond what an individual employee is able to pay.

“It defies logic that anyone would continue to stay in the traditional plan,” observed Daniel Hackler, Personnel Director for the State of Indiana, in the CDT piece.

Why It’s Working in Indiana

The CDT writer offers at least three reasons for Indiana’s greater success with CDHPs compared to other states:

- First, Indiana offers an intensive education and outreach program to overcome barriers to consumer acceptance of the new plans.

- Second, the state’s carrier is Anthem of Indiana. One of the largest providers of CDHPs in the country, Anthem offers easily accessible comparative information on local healthcare services across the state.

- Third, and perhaps most important, Indiana’s generous HSA contribution attracts participation.

Clinical laboratory managers and pathologists will consider it notable that, collectively, it is estimated that state employees now have a total of $49 million in their HSA funds. Many of the state’s individual subscribers have more than $10,000 each in their HSAs.

There are several insights to be gleaned from these developments. First, Indiana is demonstrating that a properly-designed consumer-directed health plan can motivate patients to take a more active role in selecting their provider of choice while negotiating a better price for their healthcare services.

Second, the rather dramatic build-up in the HSA accounts, to $49 million in the first five years that Indiana has offered this CDHP to state employees shows that it is possible for individual consumers to accumulate a sizeable nest egg in their HSAs. In turn, the funds in their HSAs give patients greater peace of mind that they have a financial reserve at hand to handle more costly medical emergencies.

Third, it may also be true that, with consumers taking a greater role in selecting their providers, Indiana state employees with HSAs may be making independent choices about which clinical laboratory they use for their medical lab testing. This can be favorable to independent clinical laboratory companies and hospital laboratory outreach programs, since they can compete for patient lab test referrals on the quality of their services and not simply “lowest price per test.”

—Pamela Scherer McLeod

Related Information:

Indiana Places a Big Bet on Consumer

Consumer-Driven Health Plan Effectiveness—Case Study: State of Indiana

While this appears to be great, we are tinkering around the periphery of the problem. Collectively all reports indicate and agreed to by moderate republicans like Mike Castle (defeated by the Tea Party) that to ensure a permanent solution, we need to do the following instead of barking up the wrong tree:

• Hospital and pharmaceutical costs have to come down dramatically.

• Articles say physician salaries are the next big issue and I say, physicians churning the system are the big issue.

• Intense education on good habits (smoking, condoms, obesity, physical activity etc.).

• Evidence based medicine and use of EMR; physicians order tests not because they are defensive but because they don’t give a damn about the cost; we need economic credentialing!!

• While HSAs are great and DPS promotes it, HSA also prevents people from the getting required help.

I absolutely agree that every person should pay for their insurance like they do for their vehicles but only if they can afford it and they don’t get screwed by corporate mismanagement (Banking, Insurance, Oil, Auto trying to build gas guzzlers, WorldCom, Enron, Madoff). Employees need to be protected against such atrocities that go unpunished similar to the Government that goes to war and sucks up to the Saudi Kings instead of fixing the industries, demanding rich Arab Nations to fix the terrorists and asking Israel to get out of Palestine . If they have jobs that depend on good health, they will pay for their insurance and the Govt. can be out of it.

All of this can be solved only by campaign reform! and using science, brain and may Drone!! I was a Reagan, Dole, Father Bush and Paul supporter! & that is my OpEd! Thanks for listening