State and federal investigations into possible antitrust violations arising from provider consolidation could have implications for the nation’s independent medical laboratories

Physician-practice acquisition deals are drawing increased scrutiny from federal and state investigators concerned about possible antitrust violations. Because ownership of medical groups can play a role in how the owners decide on a medical laboratory testing provider, these anti-trust reviews could inhibit concentration of ownership by large hospitals or health systems.

Hospitals, private equity firms, and even health insurers are racing to buy up independent physician practices. At the same time, physicians are open to selling their medical practice and working as employees after the sale is completed.

Changes to the Clinical Laboratory Testing Marketplace

This trend is propelled by healthcare reform, adoption of value-based reimbursement and other forces. In many communities, the volume of transactions is changing the status quo in market share. Further, a change in ownership of medical groups in a region can lead to changes in how the new owners select their clinical laboratory test provider.

“We’re seeing a lot more consolidation than we did 10 years ago,” observed Jeffrey Perry, Assistant Director of the Federal Trade Commission’s (FTC) Bureau of Competition, in a New York Times story. “Historically, what we’ve seen with the consolidation in the healthcare industry is that prices go up, but quality does not improve.”

Health Systems in Boise Battle It Out in the Courts

The consolidation-driven battle over market share has grown fierce in Boise, Idaho. There, one health system has taken to the courts to stop another health system from going forward with its latest acquisition.

As reported in the New York Times, Saint Alphonsus Regional

Medical Center (St. Al’s) filed for injunctive relief in federal district court. It sought to stop Saint Luke’s Health System (St. Luke’s) from acquiring Nampa, Idaho-based Saltzer Medical Group, the largest physician-owned practice in the state.

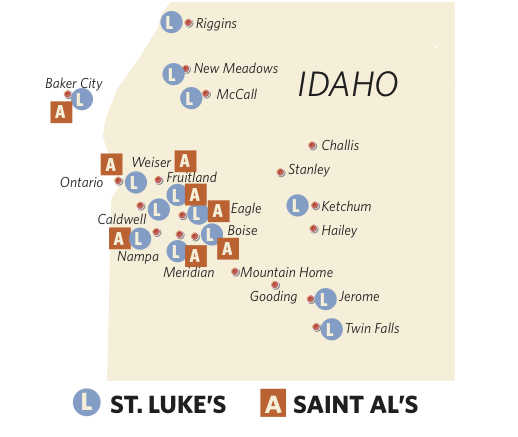

This map was prepared by the Idaho Statesman newspaper to show how the ongoing acquisition of physician medical groups by hospitals is consolidating control of office-based physician services—not just in Boise, but throughout the State of Idaho. Nationally, hospitals are acquiring physician medical groups at an accelerating pace. Over time, this trend will significantly change how clinical laboratories and anatomic pathology groups market their services to office-based physicians.

St. Al’s fears the acquisition will have a negative impact on competition, reported a story in Modern Healthcare (MH). According to the court documents, the health system’s specific concerns include fears that the new St. Luke’s-Saltzer organization would:

- dominate a primary-care service market;

- cut off a supply of patient referrals;

- have too much clout with insurance companies; and,

- drive up prices.

“As a result of St. Luke’s consolidation of power…it has been able to charge prices far above competitive levels,” St. Al’s stated in its complaint. “St. Luke’s charges approximately three times as much for [clinical] laboratory work than the independent labs in [the area].”

As reported in The Idaho Statesman, on December 20, 2012, U.S. District Court Judge B. Lynn Winmill denied St. Al’s petition for injunction. Winmill ruled that the acquisition would not cause irreparable harm to competitors. Further, he noted that the transaction can be “unwound” if St. Al’s prevails at trial this summer. He set a July 29 trial date.

Pressure to Order Unnecessary Tests, Procedures, and Admissions

In the consolidation flurry, independent physicians across the country are complaining that large systems are gaining too much power over the “medical pipeline,” the Times story reported. They claim this enables big providers to not only dictate pricing and patient admissions, but also which tests and procedures to perform.

Nationwide, only about 39% of doctors remain independent. That’s according to estimates from consulting firm Accenture, as reported in the Times. In 2000, that number was 57%.

Federal Regulators Looking for Possible Antitrust Violations

The FTC is “aggressively” monitoring business arrangements between physicians and hospitals, stated Richard Feinstein, Director of the FTC’s Competition Bureau, in the MH story. They are searching for violations of laws that prohibit rewarding doctors for admitting patients or for ordering lucrative tests and procedures.

Both the Idaho state attorney general and the FTC have ongoing investigations of the St. Luke’s-Saltzer deal, MH reported. The ultimate outcome could have significant implications for both the nation’s independent medical laboratories and hospital laboratory outreach programs.

However, there are many policy experts who favor the shift away from independent practices, the Times reported. They believe it could reduce fragmentation and lower healthcare costs. They point to systems modeled after well-known organizations such as Kaiser Permanente. These experts claim that these systems have found ways to better coordinate patient care and deliver improved services at lower costs, the Times suggested.

Choice of Clinical Laboratory Test Provider

All of this consolidation activity involving physician medical groups has at least one takeaway for pathologists and clinical laboratory managers. For a growing number of medical practices: the power to make decisions as to what providers to use for various medical services—including clinical laboratory testing and pathology services—is shifting rapidly.

—Pamela Scherer McLeod

Related Information:

St. Alphonsus sues to halt St. Luke’s acquisition of Idaho practice

Trinity Health, Catholic Health East plan to merge

St. Luke’s becomes a health care giant

Complaint for Temporary and Permanent Injunction

Federal judge: Idaho medical group acquisition can move forward

Saint Al’s Files Injunction to Delay St. Luke’s Acquisition of Saltzer