Occupancy rates at skilled nursing facilities remain well below pre-pandemic levels, a trend that weakens the financial health of nursing homes and means fewer test referrals to clinical laboratories that service them

COVID-19 is taking a financial bite out of the nursing home industry as seniors opt for home care rather than entering nursing facilities. If this trend becomes permanent, clinical laboratories may have to ramp up their ability to collect specimens from a growing population of patients who choose non-traditional healthcare settings. And as the SARS-CoV-2 pandemic stretches on, the exodus of seniors from nursing home facilities provides another example of how COVID-19 is altering consumers’ access to healthcare.

According to the most recent “AARP Nursing Home COVID-19 Dashboard Fact Sheets,” the COVID-19 pandemic “has swept the nation, killing more than 160,000 residents and staff of nursing homes and other long-term care facilities.”

Because COVID-19 has hit nursing home residents the hardest, many families have decided elderly parents may be safer living with relatives than in nursing homes that have proven vulnerable to widespread outbreaks. In addition, COVID-19-related lockdowns in skilled nursing facilities (SNFs) have provided families with additional motivation to choose home care for elderly relatives.

For example, in “Should You Bring Mom Home from Assisted Living During the Pandemic?” retired Seattle physician Alison Webb, MD, told Kaiser Health News (KHN) she moved her 81-year-old father, who has moderate dementia, out of assisted living so he could be with grandchildren and enjoy gardening rather than remain in his senior facility, where COVID-19 protocols kept him sequestered from friends and family.

This is not an isolated example and may have a long-term impact on clinical laboratories that service skilled nursing facilities.

Patient Volume Falls Dramatically at Skilled Nursing Facilities

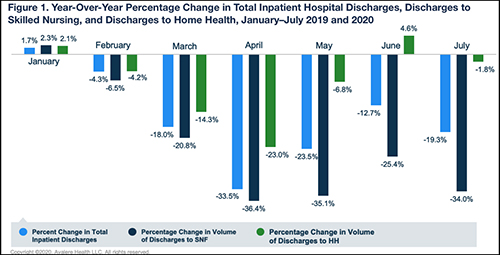

While hospital discharge rates are rebounding to near pre-pandemic levels, an Avalere Health analysis of Medicare fee-for-service claims found a “more drastic and lasting decline in patient volume” at skilled nursing facilities. In contrast, Avalere found home health has experienced a rebound in patient numbers beginning last May.

“In the early months of the COVID-19 outbreak in the US, we saw a substantial decrease in hospital discharges to both skilled nursing facilities and home health agencies,” said Heather Flynn, Consultant at Avalere, in an Avalere press release. “Hospital discharges are steadily moving back to pre-pandemic levels, but our analysis points to an uneven ‘return to normal’ across care settings.”

Bill Kauffman, CFA, Senior Principal at National Investment Center for Seniors Housing and Care (NIC), believes the skilled nursing industry may be experiencing a permanent prolonged reduction in occupancy levels.

“Skilled nursing facility occupancy typically slows in April after an uptick during the flu season, but we haven’t seen anything like this in recent memory,” Kauffman said in an NIC press release which announced nursing home occupancy had dropped to 78.9% last April, 2020, down 5.5% from 2019. “The long-term effect of COVID-19 on skilled nursing occupancy remains to be seen as the industry adjusts to a new normal.”

Since then, the occupancy rate in skilled nursing properties has fallen even further. The latest Skilled Nursing Monthly Report announced a new low of 74.2%.

Will Clinical Laboratories That Service Skilled Nursing Homes Be Affected?

Low occupancy rates may be pushing the nursery home industry toward a financial crisis. According to an August 2020 survey conducted by the American Health Care Association (AHCA) and National Center for Assisted Living (NCAL), 55% of the nation’s nursing homes are operating at a loss and 89% operate with a profit margin of 3% or less.

There are signs the nursing home industry may have to contend with home healthcare becoming a permanent competitor for patients. In a news release last spring, the Mayo Clinic announced it was partnering with Medically Home of Boston to launch a virtual hospital-at-home model aimed at delivering “advanced care” from a network of paramedics, nurses, and support team in a home care setting.

The initiative means patients can receive a range of healthcare services in their homes that traditionally required a hospital setting. The services include:

- Infusions,

- Skilled nursing,

- Clinical laboratory and imaging services,

- Behavioral health and rehabilitation services.

While the initial program rollout will allow Mayo Clinic to free up ventilators and hospital space for COVID-19 patients, John Halamka, MD, an emergency medicine physician and President of Mayo Clinic Platform, told Modern Healthcare, “Next, we’ll look to forward-thinking organizations who believe like we do in that care should be more convenient and accessible.”

Discharge Doctors Now Choose Home Healthcare Over Skilled Nursing Facilities

Physicians also are embracing home care in greater numbers. As reported in Forbes, a 2020 William Blair survey showed 81% of physicians responsible for discharge planning would send patients to a home health agency rather than a skilled nursing facility. Pre-pandemic, only 54% of discharging physicians expressed a preference for home care, according to the survey.

Greg Chittim, Partner at Health Advances, an international strategy consulting firm headquartered in Boston, points to improvements in virtual technologies as the catalyst for home care’s growth.

“One of the silver linings of COVID-19 is the level of investment we are seeing in virtual care technologies,” Chittim told Forbes. “And beyond the technologies, providers and patients are building that comfort with traditional real-time communication. I think we have moved 10 years ahead in 10 months.”

As the COVID-19 pandemic rolls on and home health initiatives become more commonplace and grow in popularity, clinical laboratory managers may want to develop solutions that assist home healthcare providers with collecting and shipping patient specimens for testing.

—Andrea Downing Peck

Related Information:

Decline in Skilled Nursing Occupancy Continues Due to COVID-19 Pandemic

Hospital Discharges to Home Health Rebound While SNF Volumes Lag

Survey: Nursing Homes Incurring Significant Costs and Financial Hardship in Response to COVID-19

Mayo Clinic Launches Advanced Care at Home Model of Care

Mayo Clinic to Launch National Hospital-at-Home Model

Skilled Nursing Occupancy Reached New Low in November 2020

While Hospital Discharges to Home Health Rebound, SNFs See Drastic and Lasting Decline

Home Healthcare Is a Bright Light During COVID-19 with an Even Brighter Future