This is the second of a three-part series on revenue cycle management for molecular testing laboratories and pathology practices, produced in collaboration with XiFin, Inc.

Second of a 3-part series, this article will detail what molecular diagnostics and pathology groups need to understand about coding, billing, and denial management to maximize revenue and cash flow successfully.

In the first article, we discussed how molecular diagnostics and pathology groups can enhance the patient experience, physician engagement, and payer relations. Now, we will detail how denial management can successfully maximize revenue and cash flow. As we discussed in the last article, revenue cycle management (RCM) is much more than billing.

Today’s rapidly changing environment of directives and expectations from payers, patients, and health systems require deeper understanding, great agility, and strategy in every aspect of business. Creating opportunities to provide better service, adopt state-of-the-art technologies, and build robust processes and partnerships can make or break the long-term success of a laboratory or pathology practice.

Technical assessments are often required to establish clinical validity and utility to achieve payer coverage for novel genetic tests. Achieving payer coverage requires a deep understanding of how-to code tests compliantly and to facilitate reimbursement.

“We recommend that molecular diagnostics laboratories consult with coding experts to fully understand the coding requirements for each genetic test,” says Clarisa Blattner, XiFin Senior Director, Revenue and Payor Optimization. “Ensuring reimbursement requires knowing payer policies and to track denial trends by payer over time to identify changes.”

Blattner noted that payer policies and behavior are constantly changing. Labs, and their billing partners must stay abreast of changes to avoid lengthy delays that denials and subsequent appeals can cause. Understanding the documentation that is required with claims is invaluable. Knowing these requirements up front and submitting complete claims with all required medical records and documentation of medical necessity goes a long way toward facilitating reimbursement.

Payers are adopting increasingly rigid policies that are often inconsistent with others. Reimbursements continue to be cut while quality reporting requirements rise.

Diagnostics laboratories that conduct genetic testing must also overcome four common challenges:

- Achieving and expanding payer coverage with coverage determination that defines reasonable and medically necessary services and tests.

- Knowing how to code the tests correctly with medical nomenclature to report services and/or tests to a payer.

- Ensuring payment/reimbursement for services/tests based on services/tests rendered and coverage determination.

- Maintaining compliance and keeping abreast of billing compliance and having a voice in reform

“We also recommend that laboratories conduct internal audits that reconcile laboratory information system (LIS) data with RCM system data,” Blattner continued. “Labs with a robust business intelligence (BI) solution can proactively identify outliers, such as accessions that exist in one system but not the other.”

Maintain Your Billing System and Maximize Clean Claim Submissions

Laboratories should be sure that these four payer services are being handled appropriately, whether it is by the lab or an RCM partner:

1. Payer relations: An effective payer relations team monitors denials and coordinates with payers. This team reviews front-end payer rejections, coordinates with clients (i.e., ordering physicians), and identifies and updates edits based on payer policies and behavior changes.

2. Electronic data interchange (EDI) enrollment: This team handles monitoring and proactive enrollment for electronic submissions and helps ensure bidirectional transaction automation.

3. EDI analysts: Experts in healthcare EDI who investigate errors, participate in standards development and testing, as well as payer education and coordination.

4. EDI operations: These specialized technicians configure files and ensure the reconciliation of claim-level submissions.

Efficiently Upload and Store Medical Records and Documentation

Although laboratories do not directly control patient medical records, it is essential to understand that diagnosis codes alone are generally insufficient.

Laboratory sales representatives must work with clients and ordering physicians to ensure medical records have all the information required for payment. Ensuring that the payers expedite payment requires efficient uploading and storing of medical records and documentation:

- Align with payers on clinical utility evidence requirements, current billing policies, and preferred coding approach.

- Leverage the support and advocacy of key opinion leaders (KOLs).

- Collaborate with clinicians on the prior authorization process.

- Select an RCM partner that helps you maximize process automation and front-end edits.

- Leverage a business intelligence (BI) system that simplifies the tracking of key performance indicators (KPIs), helps identify payer policy and behavior changes early, and highlights changes in key business trends.

The RCM system must be able to upload and store medical records and documentation. The required medical information typically includes the following:

Who? Ordering/referring provider.

What? What service(s)/test(s) is/are being ordered?

Where? Where is the specimen being sent?

When? What is the date of service (DOS)?

Why? What are the patient’s signs/symptoms, or what prompted the test to be ordered?

How? How are the test results used to manage the patient’s medical condition?

But even after including all of the correct medical information, denials are inevitable. There are important steps labs can take to streamline denial management.

The Importance of Patient Engagement in Maximizing Reimbursement

Patient engagement plays an essential role in facilitating reimbursement and maximizing cash collection. Patients expect transparency and ease of information access from their healthcare encounters, just as they experience in all other areas of their lives. Because most laboratory, pathology, and molecular encounters are not directly patient-facing, proven payment accelerating engagement tools are essential. Dynamic portals, electronic statements, and text messages are essential, especially when it comes to communication regarding errors and patient financial responsibility.

XiFin customer data show a substantive increase in patient payments received in the first 30 days of the dunning cycle after integrating texting and automated calls into the traditional process. For example, a XiFin customer collected 26.6% more of the revenue in the first 30 days after implementing a text reminder between the first and second paper statements. Prior to implementation, the customer followed a traditional three-statement dunning cycle:

- 42.6% of total payments received occurred after the first statement (within the first 29 days of the dunning cycle).

- 34.8% occurred after sending the second statement (between days 30-59 of the dunning cycle).

- 22.6% were received after sending the third and final statement (during days 60-90 of thedunning cycle).

| Dunning Cycle Period | Before | After | Increase/ (Decrease) |

| Days 1-29 | 42.6% | 69.2% | 26.6% |

| Days 30-59 | 34.8% | 27.8% | -7.0% |

| Days 60-90 | 22.6% | 3.0% | -19.6% |

The convenience of text messaging allows patients to connect to the call center or to the patient portal, where a payment can be made immediately. XiFin customers can customize their dunning cycle, depending on how their specific patient population responds to texts, paper statements, and the timing between billing cycles. Studying the behaviors of patient interactions at the client level, rather than only referencing the status quo of macro-level trending, empowers a more strategic approach to engagement and improving overall patient satisfaction.

Denial Trends Driving Reduced Revenue and Higher Costs

Denials extend time in accounts receivable, contributing to bad debt on services already rendered and laboratory expenses absorbed. Denials also often require the most attention from staff – increasing the cost of billing. Hard denials, such as Medical Necessity, make up the most challenging revenue to collect, comprising about 5-10% of total denials received. In addition to creating delays and revenue loss, denials illustrate how payers administer their policies, even when those policies are unpublished.

Fundamentally, an effective RCM process is rooted in the ability to file clean claims to the degree that is possible. Improving those outcomes requires focus on the exceptions – the dirty claims – the denials.

“At XiFin, we invest in front-end configurations and workflows to catch denials prior to submitting the claim to the payer,” continued Blattner. “As we monitor denial trends, we build more robust front-end workflows and add automation (such as integrating with insurance discovery and prior authorization vendors) to reduce the associated burden on billing teams.”

In addition, molecular testing coverage continues to expand, reducing non-covered denials. The stabilization of these medical policy-related denials is positive. The jump in demographic denials, however, requires additional consideration.

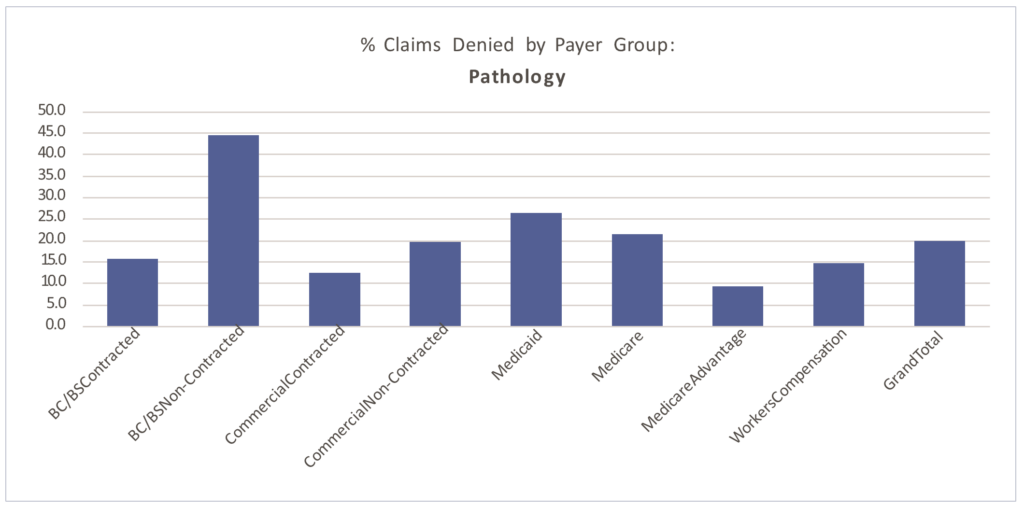

Paid vs. Denied by Payer Group

Denial patterns vary among payers. The percentage of claims denied also differs by segment, largely due to the type of testing performed.

Of the claims XiFin processes annually (approximately $50 billion in charges), 22.5% are denied. The graphs below demonstrate molecular testing’s higher propensity for denial (27.5% of claims billed), driven by non-covered, medical necessity, and prior authorization requirement challenges.

Routine pathology has closer to a 20% denial rate overall. The average percentage of billed claims that are denied by segment are:

■ Clinical: 13.62%

■ Molecular: 27.19%

■ Pathology: 19.82%

Molecular testing has a higher propensity for denial (27.5% of claims billed), driven by non-covered, medical necessity, and prior authorization requirement challenges. Routine pathology has closer to a 20% denial rate overall.

Clinical laboratory denial rates averaged 13.62% in 2021. As seen in the table below, clinical laboratories saw a significant decline in experimental/investigational denials between 2018 and 2021.

| Denial Type | Molecular % of Total Denied 2018 | Clinical % of Total Denied 2021 | Variance (% change 2021 vs. 2018) |

| Benefit Maximum Reached | 39.3% | 29.7% | -24.4% |

| Claim Specific Negotiated Discount | 17.6% | 18.1% | 2.8% |

| Coordination of Benefits | 4.1% | 16.3% | 298% |

| Coverage Terminated | 6.6% | 13.4% | 103% |

| Diagnosis Not Covered | 11.3% | 6.4% | -43.4% |

| Duplicate Denial | 8.3% | 3.4% | -57.8% |

| Experimental Investigational | 0.1% | 2.7% | 2600% |

| HSA | 2.1% | 2.4% | 14.3% |

| Incorrect Payer | 0.9% | 1.6% | 77.8% |

| Non-Covered | 2.2% | 1.1% | -50.0% |

| Patient Cannot be Identified | 0.7% | 0.8% | 14.3% |

| Patient Enrolled in Hospice | 0.5% | 0.5% | 0.0% |

| Prior Authorization | 0.2% | 0.2% | 0.0% |

| Procedure Code Inconsistent with the Modifier Used or a Required Modifier is Missing | 1.6% | 0.1% | -87.5% |

| Procedure Not Paid Separately | 0.5% | 0.1% | -60.0% |

| Service Not Payable per Managed Care Contract | 0.1% | 0.0% | -100% |

Molecular claims continue to experience the highest denial rates of any laboratory segment. With an average denial rate of 27%, molecular continues to be a revenue recovery workflow heavy on the back-end. As a percentage of the total denial population, between 2018 and 2021, XiFin experienced increases in patient-coverage denials, such as coordination of benefits (298%), coverage terminated (103%), and experimental/investigational (2600%). Decreases in diagnosis not covered denials (-43.4%) and duplicate denials (-57.8%) are also recognized.

Exome/Genome Testing must be administered by specialized technicians with specific credentials, creating potential backlogs. They can take 8, 12, or even 16 weeks to complete, depending on testing methodologies. This presents a high risk of timely filing denials for the many payers that have adopted 90-day timely filing limits. XiFin recommended practice: Explore amending your payer contracts to extend timely filing limits on these tests.

| Denial Type | Pathology % of Total Denied 2018 | Pathology % of Total Denied 2021 | Variance (% change 2021 vs. 2018) |

| Prior Authorization | 28.9% | 36.1% | 24.6% |

| Duplicate Denial | 21.5% | 21.2% | -1.9% |

| Non-Covered | 14.1% | 10.1% | -27.7% |

| Services Not Prov. By Network/Primary Care Provider | 8.8% | 8.5% | -3.4% |

| Procedure Not Paid Separately | 4.4% | 5.1% | 15.9% |

| Services Not Authorized by Network/Primary Care Provider | 3.6% | 3.8% | 5.6% |

| Procedure Code Inconsistent with the Modifier Used or a Required Modifier is Missing | 1.5% | 3.3% | 120% |

| Coverage Terminated | 2.2% | 2.6% | 18.2% |

| Coordination of Benefits | 3.8% | 2.4% | -34.2% |

| Patient Cannot Be Identified | 3.1% | 2.3% | -25.8% |

| Remark Code | 5.9% | 2.1% | -64.4% |

| Experimental Investigational | 1.0% | 1.2% | 20.0% |

| Benefit Maximum Reached | 0.4% | 1.0% | 175% |

| Patient Enrolled in Hospice | 0.4% | 0.1% | -75.0% |

| Incorrect Payer | 0.0% | 0.1% | 100% |

| Service Not Payable per Managed Care Contract | 0.2% | 0.0% | -100% |

Anatomic pathology denials have increased by approximately 5% from 2018 to 2021. As a percentage of the total denial population, the lack of prior authorization is the highest contributor to this increase, having grown 24.6%. There was an increase in procedure code inconsistent with modifier denials (120% increase) and a decrease in non-covered denials (-27.7%).

Importance of an Efficient and Effective Appeals Process

Front-end edits and configurations help mitigate backend denials. Capturing potential denial-related issues proactively are the most effective way to maintain a manageable AR and improve the propensity to pay. For example, payers that observe National Correct Coding Initiative (NCCI) and Medically Unlikely Edits (MUEs) will consider all Current Procedural Terminology (CPT) codes billed for that patient for the same Date of Service (DOS), even when not billed on the same claim form.

Denials are inevitable if your current billing process does not have edits in place to perform a historical review of charges for the same patient on the same DOS.

Denials are unavoidable, and not all known issues can be addressed on the front end of the process. An example of this is denial code CO252, which is an additional information denial. It indicates the payer is requesting additional documentation (i.e., clinical information, medical records, and test results) before issuing payment – essentially performing an audit to ensure the services billed are reasonable and necessary and medical necessity is justified and documented.

“These are not always complex molecular tests; they can be routine pathology claims,” said Blattner “Each time we receive a CO252 denial it has to be appealed with additional documentation found in the patient’s medical records. Though it is inevitable, we must wait on the denial before we can take action.”

| Segment | Appeal-Payments as % of Total Insurance Payments Received | Average Payment Amount per Appeal |

| Clinical | 0.11% | $121 |

| Molecular | 6.56% | $1,420 |

| Pathology | 1.12% | $327 |

| Industry Average | 3.39% | $623 |

Payment collection per appeal continues to be stable in the pathology (averaging 1-2%) and clinical segments, where appeals are less prolific. Revenue recovered by corrected claims is excluded since these claims follow a separate process and impact denial codes such as CO97 (Procedure or service isn’t paid for separately), CO18 (Duplicate), and CO234 (Procedure not paid separately). Further, a single appeal process is not sufficient. A robust appeals process here becomes critical. Specifically in molecular testing, appeals carry a heightening impact on revenue collection. In 2020, appeals accounted for 5% of the total revenue generated by XiFin customers. In 2021, that increased to 6.5%.

Appeal Success Rates by Payer Group by Segment

The next four charts show appeal success rates by payer group for 2021, overall and by market segment for clinical, molecular, and pathology. The fifth chart illustrates the incremental impact of multiple appeal attempts by market segment.

This assessment only includes activity related to revenue recovery through an appeals process. Some denials can be addressed by filing of a corrected claim and can be a much more efficient process. Although ideal, corrected claims are not always possible, depending on denial type and individual payer preferences.

| % of Total Appeals Filed | % of Appeals Paid after 1st Attempt | % of Appeals Paid after 2nd Attempt | % of Appeals Paid after 3rd Attempt | Avg Payment per Appeal | |

| Clinical | 17.4% | 17.8% | 9.9% | $ 276 | |

| Additional Information | 70.1% | 20.9% | 20.3% | 10.0% | $ 258 |

| COVID Medical Necessity | 8.9% | 3.9% | 50.0% | $ 78 | |

| Medical Necessity | 4.8% | 30.4% | 18.4% | $ 553 | |

| Out of Network | 6.9% | 4.4% | 2.4% | $ 594 | |

| Prior Authorization | 0.0% | 14.3% | 0.0% | $ 421 | |

| Underpayment | 9.3% | 6.9% | 6.3% | $ 10 |

The clinical laboratory segment maintains the lowest volume of denials. But this does not negate the need for robust editing processes. Implementing robust front-end logic and leveraging intelligent automation to correct potential issues dramatically streamlines the process from submission to payment, especially in the high-volume clinical laboratory segment.

| % of Total Appeals Filed | % of Appeals Paid after 1st Attempt | % of Appeals Paid after 2nd Attempt | % of Appeals Paid after 3rd Attempt | Avg Payment per Appeal | |

| Molecular | 21.4% | 17.2% | 19.4% | $1,420 | |

| Additional Information | 47.7% | 23.9% | 20.7% | 23.3% | $1,285 |

| Medical Necessity | 23.0% | 17.6% | 14.0% | 12.8% | $1,518 |

| Prior Authorization | 11.4% | 18.9% | 11.7% | 13.1% | $1,944 |

| Experimental and Investigational / Non-Covered | 5.6% | 13.2% | 9.0% | 9.0% | $4,234 |

| COVID Underpayment | 3.8% | 44.7% | 24.6% | 10.7% | $52 |

| Timely Filing | 3.5% | 10.1% | 8.3% | 18.9% | $551 |

| Out of Network | 3.5% | 14.0% | 10.8% | 8.4% | $2,513 |

| Underpayment | 1.1% | 31.2% | 17.8% | 15.3% | $2,154 |

| COVID Medical Necessity | 0.4% | 46.4% | 27.0% | 0.0% | $124 |

Appeal Trends: Molecular and Genomic Testing At $1,420, the average payment per appeal for molecular testing is more significant due to the high-dollar value of the testing. Additional information appeals account for 47% of the total appeals filed in 2021 in the molecular segment and have an average success rate of 23%. Another 23% of appeals are for claims denied for medical necessity, followed by prior authorizations at 11.4% of total appeals filed. Prior authorization appeal volumes have remained consistent year-over-year in this segment, averaging 10% in 2020, despite a higher volume of prior authorization requirements than pathology or clinical laboratory.

XiFin’s RCM platform has integrated automation with prior authorization partners, allowing claims meeting prior authorization criteria to be submitted to a prior authorization solution automatically. Utilizing “real-time data exchange” via application programming interfaces (API) without partners, XiFin can more quickly acquire the necessary prior authorization number and update the patient’s information in XiFin RPM upon those values being returned.

| % of Total Appeals Filed | % of Appeals Paid after 1st Attempt | % of Appeals Paid after 2nd Attempt | % of Appeals Paid after 3rd Attempt | Avg Payment per Appeal | |

| Pathology | 22.6% | 20.6% | 21.8% | $327 | |

| Additional Information | 33.4% | 28.8% | 23.4% | 27.9% | $337 |

| Medical Necessity | 19.0% | 23.5% | 23.4% | 27.6% | $398 |

| Out of Network | 17.9% | 17.6% | 12.4% | 17.7% | $318 |

| Prior Authorization | 12.2% | 21.5% | 32.9% | 36.5% | $350 |

| Experimental and Investigational / Non-Covered | 9.2% | 17.8% | 8.9% | 3.1% | $195 |

| COVID Underpayment | 5.8% | 9.0% | 3.4% | 16.7% | $31 |

| Timely Filing | 2.5% | 20.5% | 15.6% | 13.3% | $191 |

| Underpayment | 0.1% | 52.2% | 0.0% | $177 |

Appeal Trends: Pathology

Approximately 2% of the pathology accessions received into XiFin RPM require an appeal. Those appeals will be responsible for approximately 1-2% of the pathology practice’s revenue. As noted above, the revenue reclaimed is largely attributed to the first attempted appeal. A robust process that includes multiple attempts is critical in revenue recovery in the event the first appeal is not overturned.

If Not Documented, It Did Not Happen

Payer edits and guidelines can be difficult to follow, particularly if physicians, coders, or billing staff are expected to memorize those requirements.

Making the situation even more challenging is the fact that edits vary widely among payers and are constantly changing. RCM platforms should be updated routinely (XiFin RPM is updated monthly) with payer edit updates, while remaining configurable so that custom edits can be easily built to accommodate specific payer requirements.

Whether it is a payer audit or packaging an appeal, documentation in the pathology report and/or clinical notes should clearly outline the services provided and the medical necessity of those services. If it is not documented, it did not happen. Further, understand the various programs that drive payer edits and guidelines. These edits drive an increased need for discipline and documentation. Be conscious of payer-specific requirements. Cigna, Aetna, and UHC require proprietary forms to be completed when appealing claims.

Benchmarking Productivity

Proactively preventing a denial and avoiding the need to submit a corrected claim or file an appeal reduces the time to reimbursement by four to eight weeks, depending on the payer and type of denial. If denials are not addressed properly and manual workflows persist, diagnostic labs will continue to experience a loss of revenue, and staffing will be insufficient to keep up.

Productivity rates for anatomic and molecular billing teams historically average between 12,000-15,000 accessions per person per full-time equivalent (FTE) per year (clinical laboratory is often much higher). However, with the increases in denials, the resulting demands on back-end teams have increased substantially and impacted productivity rates. This holds particularly true for particularly non-covered, medical necessity, and prior authorization denials.

Further, speed to payment is also improved. By automating appeals, the turn-around-time on submitting back to the payer is reduced, on average, from 45 days to 1-3 days, as seen in the blue bar in the chart above.

By installing front-end edits to help maximize clean claims, up to an additional 54 days can be saved, moving from 135 days to just 30 days for full adjudication.

Automating Workflows with AI

Opportunities to automate the process will reduce time and labor and make decisions more consistent. Once there is a deep understanding of coding, billing, denial management, and strategic appeals, there is the ability to automate the important processes across the RCM process. Automation and AI-powered workflows pave the way for consistent, optimized molecular diagnostics and pathology RCM.

Part 3 will demonstrate how AI can be used in RCM to inform, accelerate, automate, validate, and generate. Watch for updates here at DarkDaily.

— Leslie Williams