Actions by major insurers indicate that ACOs operated by hospitals will have competition

Until recently, most media coverage about nascent accountable care organizations (ACOs) centered on the plans of major hospitals and health systems to organize ACOs within their communities. Now comes news that major health insurers are making sizeable investments as they prepare to launch their own ACOs.

These developments could be auspicious for local clinical laboratories and anatomic pathology groups. It could mean that in many regions around the United States there will be ACOs operated by hospitals/health systems that compete against ACOs operated by health insurance companies. In turn, that would mean more customers for lab testing services in these cities and towns.

A string of healthcare information technology deals by large health insurance companies over the past eight weeks signals that private players intend to compete vigorously by operating their own ACOs. Announced on February 14, one deal saw three Blue Cross and Blue Shield health plans join forces with the HIT company Lumeris Corp. and announce plans to acquire NaviNet. Based in Boston, Massachusetts, NaviNet says it is the largest real-time healthcare communications network in the United States.

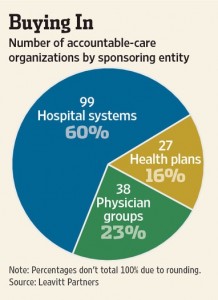

As this pie chart demonstrates, private health insurers are actively developing accountable care organizations in competition with hospital systems and physician groups. In communities where multiple ACOs are in operation, that should provide competitive opportunities for local laboratories to provide services to more than one ACO. (Graphic copyright by The Wall Street Journal.)

The three BCBS plans are: Highmark, Horizon Blue Cross Blue Shield of New Jersey (Horizon), and Independence Blue Cross (IBC). The willingness of these BCBS organizations to partner with Lumeris to do an IT acquisition is significant. That’s because, collectively, these insurers work with more than 70,000 physicians and insure 11 million people.

In the press release announcing the agreement, it was stated that NaviNet delivers “more than 50 kinds of administrative, financial and clinical transactions among three-quarters of America’s physicians, 3,800 hospitals, and dozens of the nation’s largest health insurers, including Highmark, Horizon and IBC.”

Based in St. Louis, Missouri, what Lumeris brings to the party is a menu of cloud-based services and software that is designed to support population management needs for accountable care organizations.

Also on the same day, February 14, UnitedHealth Group’s (NYSE: UNH) health services division, Optum, issued a press release announcing the launch of a cloud-based informatics system that would allow healthcare professionals to connect with patients’ other providers. Optum executives explained that this capability was a necessary step for the company to fully participate in accountable care organizations (ACOs).

“Growing use of electronic health record (EHR) and health information exchange (HIE) technology is unlocking rich information about patient clinical experiences that has historically been confined to paper records. In a secure environment that protects privacy, Optum Care Suite marries this information with related health claims, patient-reported outcomes and Optum’s analytics capabilities,” noted the Optum press release.

These acquisitions and launches are a visible sign that health insurers are taking the development of ACOs seriously and they want to get in on the act. And, popular wisdom expects that ACOs will play a growing role during coming years. This will be accompanied by significant changes in how providers—including ACOs—will be paid.

Horizon Blue Cross and Blue Shield of New Jersey invested in Lumeris because “[It] fits into the Horizon business model, which calls for moves into accountable care and different payment methodologies,” stated Douglas Blackwell, Senior VP and CIO at Horizon in a story published in Modern Healthcare.

“We see this as another opportunity to have an integrated platform,” added Blackwell. “When you look at the geography of Highmark, Horizon and IBC, we’re geographically aligned and it’s going to make sense to do things collaboratively going forward.”

Blackwell’s comments demonstrate how health insurers are rethinking their role in a healthcare world where fee-for-service payment and fragmented care by different providers yields to new reimbursement models centered around active management of a defined population of patients. The investments in healthcare informatics are a sign that clinical laboratories and pathology groups should have their own robust information technology capabilities in place to serve the fast-changing needs of both office-based physicians, but the private payers who are involved in these new healthcare delivery models.

Further, pathologists and medical laboratory managers should stay current with these developments. Hand-in-hand with physician adoption and use of EHRs in conjunction with the engagement of ACOs in care delivery will be the need for the clinical laboratory to interface the laboratory information system (LIS) with the electronic medical record (EMR) systems of their parent hospital/health system, as well as the EMRs of the office-based physicians in the community.

—By Mark Terry

Related Information:

Muscling in on IT: Insurers see acquisitions as key to data-sharing

Blues Plans, Lumeris Partner to Acquire Nation’s Largest Real-Time Health Care Communication Network

Accountable Care Organizations

Medical organizations created in northern N.J. to focus on preventative care