New strategy by employers and payers encourages patients to choose lower-cost providers, or pay the difference over the price cap

Payers are teaming with employers to steer patients to lower cost providers. Their common goal is to reduce the cost of care without compromising the quality of care delivered to their beneficiaries. This trend may involve clinical laboratories and anatomic pathology groups, particularly where a lab is seen as a high-cost provider in its service area.

There is credible evidence that patients are willing to consider lower-cost providers. For example, a pilot project aimed a cutting the cost for knee and hip surgeries saved $5.5 million for the California Public Employees Retirement System (CalPERS), the nation’s largest pension fund and third largest purchaser of healthcare benefits.

The Los Angeles Times report of this story noted that this was a savings of 17%.

CalPERS Teamed with WellPoint to Develop Capped Pricing Program

The pilot program was launched in 2011. CALPERS worked with Wellpoint, Inc.’s (NYSE: WLP) Anthem Blue Cross division. Also participating was Wellpoint’s research division, HealthCore, which set a top “reference price” of $30,000 for these surgeries.

One consequence of this pilot program was that the number of California hospitals willing to do these procedures for less than $30,000 increased to 54. The average price among the high-priced hospitals dropped 37%, from $43,308 in 2010 to $27,149 this year. By contrast, the average price for CalPERS members at the preferred hospitals was just $24,528.

Insurers Enlisting Consumer Help to Drive Down Provider Prices

It was the differential between the least-cost and most-cost hospitals that caught the attention of CalPERS, according to a Bloomberg.com news story. CalPERS decided to participate in the pilot program after a Wellpoint analysis revealed that prices charged by various hospitals for similar hip and knee surgery procedures—even in the same region—may range from $15,000 to $110,000.

CalPERS/Anthem Program Was Structured as Reverse Deductible

The CalPERS/Anthem pilot did not limit its members to a specific provider network. Rather, members were given a list of 46 hospitals in California that had agreed to keep the cost for these specific services below $30,000. This strategy works essentially like a reverse deductible, noted The Los Angeles Times report, with the insurer paying costs for these services up to $30,000. Members were free to see a provider of their choice, but would be personally responsible for any costs above the $30,000 threshold.

During the pilot program, about 400 CalPERS members chose to use one of the 46 preferred hospitals on the list. The list included some hospitals highly regarded for quality of care, such as Los Angeles’ Cedars Sinai Medical Center.

Preferred Hospitals Provided Better Quality of Care at a Lower Price

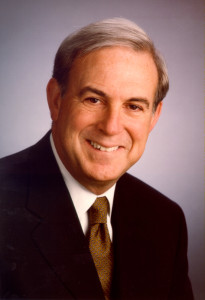

In a phone interview, Sam Nussbaum, M.D. the Cincinnati-based insurer’s Chief Medical Officer, told Bloomberg.com reporter Alex Nussbaum that there was another benefit to this pilot program. It turned out that rates of hospital-acquired infections and readmissions were lower among patients using these preferred providers, compared with a group of knee and hip patients who didn’t use the designated hospitals. Nussbaum also noted that members’ out-of-pocket costs for deductibles and coinsurance showed little change under the program even as health outcomes stayed steady or improved, he said.

Wellpoint Chief Medical Officer Sam Nussbaum, MD, pictured here, noted in a Bloomberg.com report that rates of both hospital-acquired infections and readmissions were lower among those pilot participants who chose one of the preferred providers as part of the capped pricing pilot program offered in California by CalPERS and Anthem Blue Cross. These rates were compared with a group of knee and hip patients who didn’t use the designated hospitals. (Photo copyright Wellpoint, Inc.)

Project Sets Off Employer Movement to Capped Pricing Nationwide

Additionally, the success of this project in lowering healthcare costs has encouraged other employers nationwide to take steps to launch similar capped-cost programs. “There were striking reductions in some of the higher-priced facilities,” stated James Robinson, a UC Berkeley professor of health economics, in the Los Angeles Times story. He studied the CalPERS/Anthem pilot program. This pricing strategy “has received a lot of interest in the large-employer world because it does seem to be an antidote to aggressive hospital pricing,” he added.

The program has proven to be “an effective tool in managing costs,” concurred Ann Boynton, CalPERS’ deputy executive officer. She was quoted in the Bloomberg.com report. “We all know that current spending levels are not sustainable if we’re going to provide benefits that are affordable now and into the future.”

According to these news reports, both Kroger Co. (NYSE: KR) and Safeway, Inc., two of the nation’s largest grocery chains, have implemented reference-pricing programs.

CalPERS’ Experience Has Interested More Employers in Capped Pricing

“There is a lot of momentum building,” declared Kenneth Goulet, Wellpoint Executive Vice President and President/CEO of the Commercial Specialty Division. He granted a telephone interview with Bloomberg.com. “Employers have wanted to see the tools and the proof that it works, and now that they’re seeing that, there seems to be pretty heavy interest.” Goulet explained that about a dozen Wellpoint clients plan to implement similar programs next year.

Wellpoint, Inc., Executive Vice President Kenneth Goulet, pictured here, told Bloomberg.com that momentum for capped-pricing programs is growing because it is effective in lowering healthcare costs. He noted that at least a dozen Wellpoint clients have plans to implement programs similar to CalPERS next year. (Photo copyright Wellpoint, Inc.)

The Bloomberg.com report noted that Kroger is already using reference pricing for diagnostic tests, including MRIs and CT Scans. It is likely that the concept of “reference pricing” may be used for clinical laboratory testing sometime in the near future. In light of this trend, medical laboratories might well be advised to review their own cost structures to ensure they are not considered the highest-cost lab provider in their communities.

–Patricia Kirk

Related Information:

Surgery Cost Caps Save Pension Fund 19% Without Hurting Health

Hospitals cut some surgery prices after CalPERS caps reimbursements

ConsumerWatch: Hospital Lab Tests May Lead To Expensive Results

Obama administration lifts veil off hospital pricing

Administration offers consumers an unprecedented look at hospital charges

HHS RELEASES HOSPITAL DATA ON CHARGE VARIATION TO PROMOTE TRANSPARENCY