Pathology groups and medical laboratories here in the United States still have few opportunities to provide reference or esoteric diagnostic services to healthcare providers in other countries

Despite the lack of publicity, medical tourism continues to enjoy vigorous growth as an increasing number of Americans prove willing to cross international borders to obtain healthcare that is considered of acceptable quality, but at a price that significantly cheaper than here in the United States.

What makes the trends in medical tourism relevant for clinical laboratory managers and pathologists is that it shows how U.S. consumers are reacting to high healthcare prices and other problems within the American healthcare system. In particular, our nation is experimenting with putting tens of millions of Americans in high-deductible health plans. How these consumers decide to price-shop because of their $3,000 to $10,000 per year individual and family deductibles remains to be seen. <

New York Times Reported on Growth in In Vitro Fertilization Services Overseas

One good example is in vitro fertilization. Not only are these high-cost procedures, but they are typically not covered by health insurance. Thus, it should be no surprise that U.S. consumers are willing to travel abroad to receive such healthcare services. Last month, a column in the New York Times shared a woman’s choice to seek fertility treatment in Israel, one of the countries providing this care at a lower cost than the United States, according to her research.

Overseas prices are substantially lower. The cost of fertility services ranges from $2,600 to $6,000 in Brazil, Spain, Russia, South Africa and Israel, according to Infertility Answers, an online information service that lists the cost of fertility services worldwide.

“And the best international in vitro fertilization (IVF) clinics have proven success rates that equal or exceed the averages achieved in the U.S., U.K., and Europe,” according to a blog post published by Patients Beyond Borders (PBB), a resource for medical travelers. This blog cited, for example, the Barbados Fertility Centre, which is accredited by the Joint Commission International (JCI) and Chaim Sheba Medical Center in Israel, as examples of facilities that offer IVF services with success rates similar to U.S. and Western European facilities.

For laboratory professionals, globe-trotting patients may mean the creation of a worldwide market for pathology services and clinical laboratory testing. It can also be the source of enticing career opportunities, since more than 350 international hospitals and 500 programs have earned accreditation by JCI, an affiliate agency of the Joint Commission.

Who Are Medical ‘Tourists’?

PBB defines a medical traveler as a person traversing “international borders for the purpose of receiving medical care.” Not included, it said, are tourists needing emergency care, medical travelers’ companions, and patients making repeated healthcare encounters overseas.

Size of the medical tourism market is estimated at $24 to $40 billion annually. This is based on about eight million patients spending $3,000 to $5,000 per visit worldwide, said PBB, which predicts medical tourism will grow at a rate of 15% to 25% per annum.

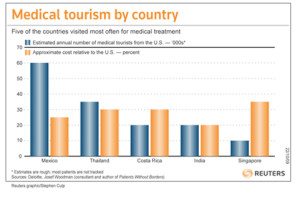

In the chart above, presents the five countries getting the most medical tourists from the United States. The blue column shows the number of people who traveled to that country for healthcare and the orange column shows, by percent, the cost of care in that country compared to the United States. (Graphic by Stephen Culp and copyright Reuters.)

Between 600,000 and 800,000 U.S. consumers sought healthcare services outside of the United States in 2012. That number grew to an estimated 900,000 people in 2013, according to PBB.

David Ellis, healthcare futurist and author, called “the rapid growth in the business of medical tourism and the offshoring of some clinical and business processes” a key trend in a recent edition of Hospitals & Health Networks. Ellis pointed out that medical travelers both save money and connect with foreign medical specialists

Healthcare futurist and author, David Ellis (pictured above) is bullish on the future of medical tourism. In a story published by Hospital and Health Networks, he wrote that medical tourism is a threat to U.S. healthcare organizations, because overseas providers can match quality at a price that is significantly less than what is commonly charged in this country. (Photo copyright Health Forum.)

Several Factors Are Pushing Growth of Medical Tourism

In an e-mail interview with Dark Daily, Anne Robertson, spokesperson for PBB, said medical tourism is on the rise for these reasons:

• Rising cost of elective medical care in developed nations (e.g. U.S., United Kingdom, Hong Kong) is forcing patients to pursue cross-border alternatives;

• Rising quality of healthcare throughout the world (e.g. Singapore, Thailand, Korea, Mexico, Columbia, Costa Rica, Czech Republic, et al);

• World populations aging into expensive medical conditions; and

• Availability (via Internet) of transparent clinical, quality and pricing information, allowing healthcare consumers to search, compare and purchase care.

PBB’s Robertson shared the organization’s top medical tourism countries, treatments and related savings (as compared to U.S. costs) with Dark Daily:

| Country | Treatment | Estimated savings |

| Antigua (St. Johns) | Addiction & recovery | 40% |

| Barbados (Bridgetown) | Fertility/IVF | 40% – 50% |

| Brazil (Sao Paulo, Rio) | Cosmetic surgery | 20% – 30% |

| Costa Rica (San Jose) | Dentistry | 30% – 70% |

| Hungary (Gyor, Budapest) | Dentistry | 40% – 75% |

| India (New Delhi, Mumbai, Bangalore) | Orthopedics, cardiology | 50% – 85% |

| Israel (Jerusalem, Tel Aviv) | Fertility/I.V.F. | 30% – 50% |

| Malaysia (Kuala Lumpur, Penang) | Health screenings | 70% |

| Mexico (Monterrey, Tijuana, Juarez) | Dentistry, bariatrics | 30% – 60% |

| Singapore | Cancer | 30% – 40% |

| South Africa (Cape Town, Johannesburg) | Cosmetic surgery | 40% |

| Thailand (Bangkok, Phuket) | Various services | 40% – 75% |

| Turkey (Istanbul) | Vision (Lasik) | 40% – 50% |

Medical Tourism Could Be a Threat to U.S. Hospitals

Medical tourism presents an interesting challenge to U.S. hospitals and health systems. Across the globe in various countries, hospitals and physicians are demonstrating proficiency and quality equal to that found in Europe and North America, yet are able to deliver those same healthcare services at prices that represent substantial savings to the medical tourist. Currently, the volume of patients leaving the United States to obtain healthcare elsewhere is a relatively small number.

But what would happen if the number of medical tourists seeking care outside the United States grew to be a significant percentage of the American population? Hospitals in this nation are not used to competing for patients by openly quoting prices and publishing their quality metrics. To be competitive and keep these patients in the United States, it would require hospital administrators to be equally competitive on both price and quality. At this moment in time, few hospital organizations are willing to take these steps to lower their prices and publicize them to interested consumers.

—By Donna Marie Pocius

Related information:

Taking an I.V.F. Journey to Israel

Medical Tourism: Promise or Peril?

Top 10 Health Care Destinations

For most North Americans Asia, in particular South East Asia is just too far. If there is a threat to the USA hospital business model from medical and dental tourism it will come from Mexico, Central America or Europe, not Asia. Basically, people will fly but around an 8 hour flight is the limit. What’s more interesting is domestic medical tourism, enterprising cities, medical, dental centers will try to market themselves as a medical tourism destination within the US, Las Vegas tries to.

Matt Kelleher

Smile Planners