Study by Kaiser Health News and NPR shows that Minnesota, Northwestern Pennsylvania, and Tucson, Arizona are among the least expensive health insurance markets in the United States

Are you lucky to live in one of the nation’s 10 lowest-cost markets for health insurance? Researchers at the Kaiser Family Foundation published a study that identifies the 10 regional markets in the United States where health insurance costs are the cheapest.

Pathology groups and medical laboratories serving these 10 regions are thus probably getting paid less fee-for-service reimbursement than in other more expensive regions of the United States. The study shows how variable the cost of the same healthcare insurance plan can be from one city to the next across the nation.

Rankings Based on Lowest Cost of a Silver Plan

The Kaiser study focused on the lowest cost for the Silver plan in a region. These Silver plans are offered by health insurance exchanges as part of the Affordable Care Act (ACA).

According the report, published by Kaiser Health News, most consumers are choosing the Silver plan, which is a mid-range option. The other plans are called Bronze, Gold, and Platinum.

Both the Kaiser study, and another study also released in February, determined that Minnesota is one of the cheapest states for health insurance. In its report, the Minnesota Department of Commerce certified that “Minnesota’s rates for health insurance policies available through MNsure, the state’s health insurance marketplace, starting October 1, 2013, are confirmed as the lowest rates compared with the other states that have released rates, including the District of Columbia—across all metal levels.”

And true to a lesson from a marketing 101 class, the cheapest health insurance costs—as measured by insurance premiums—are found in communities where there is intense competition among providers. The Kaiser study noted that when multiple hospitals and doctors vie for business, health insurance companies usually lower rates.

When interviewed by Kaiser Health News about his state’s low prices for health insurance, Minnesota Department of Commerce Commerce Commissioner Mike Rothman (above) attributed the lower cost health insurance costs to the fact that his “state moved early to enact cost-control measures, such as restricting how much insurers can spend on things other than medical care and requiring annual insurance rates to go through state review.” (Photo copyright State of Minnesota.)

In fact, healthcare consumers in managed care-haven Minnesota, northwestern Pennsylvania and Tucson, Arizona, are getting “the best bargains from the health care law’s new insurance marketplaces,” reported Kaiser Health News in its summary of the 10 least expensive health insurance markets in the U.S..

The Affordable Care Act created state marketplaces. Each state’s health insurance exchange offers consumers health insurance organized by level of care: bronze, silver, gold and platinum with the latter offering the most coverage and the former the least.

Kaiser Family Foundation researchers ranked least expensive health insurance markets by the lowest-cost Silver premium for a 40-year-old. The lowest monthly Silver premium in the nation is $154 in the Minneapolis-St. Paul area.

Ranking of 10 Least Expensive Health Insurance Markets

The table below, showing areas and counties, ranks the 10 least expensive U.S. health insurance markets, as reported by Kaiser Health News.

- $154; Minneapolis-St. Paul, as well as Anoka, Carver, Dakota, Hennepin, Ramsey, Scott, Sherburne and Washington counties.

- $164; Pittsburgh and Northwestern Pennsylvania, including Allegheny, Armstrong, Beaver, Butler, Crawford, Erie, Fayette, Greene, Indiana, Lawrence, McKean, Mercer, Warren, Washington and Westmoreland counties.

- $166; Middle Minnesota, including Benton, Stearns and Wright counties.

- $167; Tucson, Arizona, as well as Pima County.

- $171; Northwestern Minnesota, including Clearwater, Kittson, Mahnomen, Marshall, Norman, Pennington, Polk and Red Lake counties.

- $173; Salt Lake City, as well as Davis and Salt Lake counties.

- $176; Hawaii.

- $180; Knoxville, Tennessee, as well as Anderson, Blount, Campbell, Claiborne, Cocke, Grainger, Hamblen, Jefferson, Knox, Loudon, Monroe, Morgan, Roane, Scott, Sevier & Union.

- $180; Western and North Central Minnesota, including Aitkin, Becker, Beltrami, Big Stone, Cass, Chippewa, Clay, Crow Wing, Douglas, Grant, Hubbard, Isanti, Kanabec, Kandiyohi, Lac qui Parle, Lyon, McLeod, Meeker, Mille Lacs, Morrison, Otter Tail, Pine, Pope, Renville, Roseau, Sibley, Stevens, Swift, Todd, Traverse, Wadena Wilkin and Yellow Medicine counties (Chisago County’s lowest premium is $162).

- $181; Chattanooga, Tennessee, as well as Bledsoe, Bradley, Franklin, Grundy, Hamilton, Marion, McMinn, Meigs, Polk, Rhea and Sequatchie counties.

Characteristics of Least Expensive Health Insurance Market

As to its ranking as the state with the lowest insurance rates in most of its territories, Minnesota officials credit the state’s managed care experience, health-reform history and Commerce Department’s insurance rate review process, according to a news release from the state’s Commerce Department.

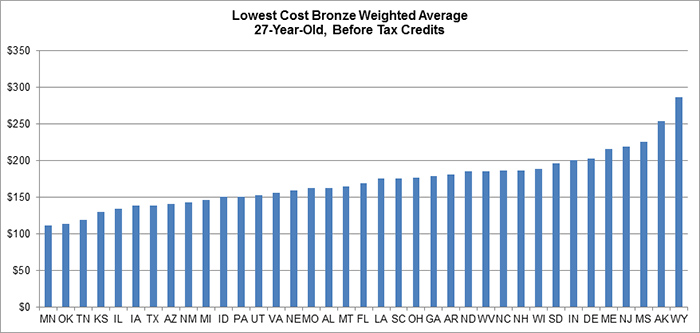

In reporting that Minnesota has the least expensive health insurance of all 50 states, the Minnesota Department of Commerce presented the chart above which shows the cost of a Bronze health insurance plan for a 27-year-old (before tax credits that subsidize the cost of the premiums. The chart shows Minnesota has the lowest price at a $110 per month premium. The most expensive is Wyoming, with monthly premiums of about $280—almost 255% greater.

Minnesota’s rate review process is one of 31 states in the country that can deny rates requested by insurance companies based upon whether the rates are justified. The process works, the news release said, as Commerce Department actuaries conduct statistical analyses and “closely scrutinize the assumptions that health insurance companies use to develop rates.”

Consumers Share Views on Health Insurance Premiums

In yet a third recently released report—this one published by the Urban Institute Health Policy Center—the public’s perceptions of the ACA were studied. The Health Reform Monitoring Survey was conducted just before the launch of the ACA’s marketplaces. It surveyed people age 18 to 64 on issues including their views on insurance coverage premiums. The study revealed that:

• 36.4% of respondents expect to be worse-off in 2014 in terms of health insurance premiums.

• 34.1% of people surveyed expect to be worse-off in regard to out-of-pocket costs.

These findings provide an appropriate segue to an upcoming Dark Daily, addressing the most expensive health insurance markets in the U.S.

For pathologists, medical technologists, and other clinical laboratory leaders and professionals, health insurance marketplace issues are important to understand. Lessons can be learned from regions like Minnesota, Salt Lake City and Hawaii. These are areas where either competition or collaboration among primary-care providers and specialists have contributed to regional markets where consumers with health insurance may perceive they are getting the most healthcare value and choice, at prices much less than in other areas of the United States.

—Donna Marie Pocius

Related Information:

The 10 Least Expensive Health Insurance Markets in the U.S.

Affordable Care Act & Health Insurance Marketplace

Commerce Department Releases Rate Analysis—Minnesota Retains the Number One Rates in the Country

Expectations for Health Care Quality, Access, and Costs in 2014

Trackbacks/Pingbacks