As reimbursement models shift, physician practice management companies (PPMCs) offer increased value and appeal for hospital-based physicians (HBPs)

Are physician practice management companies (PPMCs)—a hot trend during the 1990s—poised to make a comeback in this decade? Whether this healthcare business model can gain traction during the 2010s remains to be seen, but, of all physician specialties, pathologists are likely to be among the most skeptical, just as they were during the 1994-2000 heyday of PPMCs.

In the mid-1990s, such physician practice management companies as MedPartners, Phycor, and others raised billions of dollar to invest in both independent physician practices and hospital-based physician (HBP) groups. But not even 10 years later, competition for viable practices drove prices above sustainable levels and many PPMCs closed shop.

Few Pathologists Sold Their Group Practices to PPMCs in 1990s

During that wave of physician practice acquisitions, pathologists were among the few specialties who balked at selling their practices to PPMCs.

An article in Becker’s Hospital Review contends that in the late 1990s, deals and incentives based on profits failed to materialize as the prices needed to acquire physician groups continued to climb. Becker’s found that the returns promised by PPMCs never materialized. Thus, by 2002, 80% of the top 10 publically traded PPMCs were in bankruptcy.

Today, as Modern Healthcare noted in a recent article, PPMCs are finding new ways to form deals with hospital-based physician groups and small practices.

And, just as they did in the mid to late 1990s, once again, pathologists are resisting pressure to ride the physician group consolidation wave.

Among HBPs, Anatomic Pathology Groups Least Likely to Be Acquired

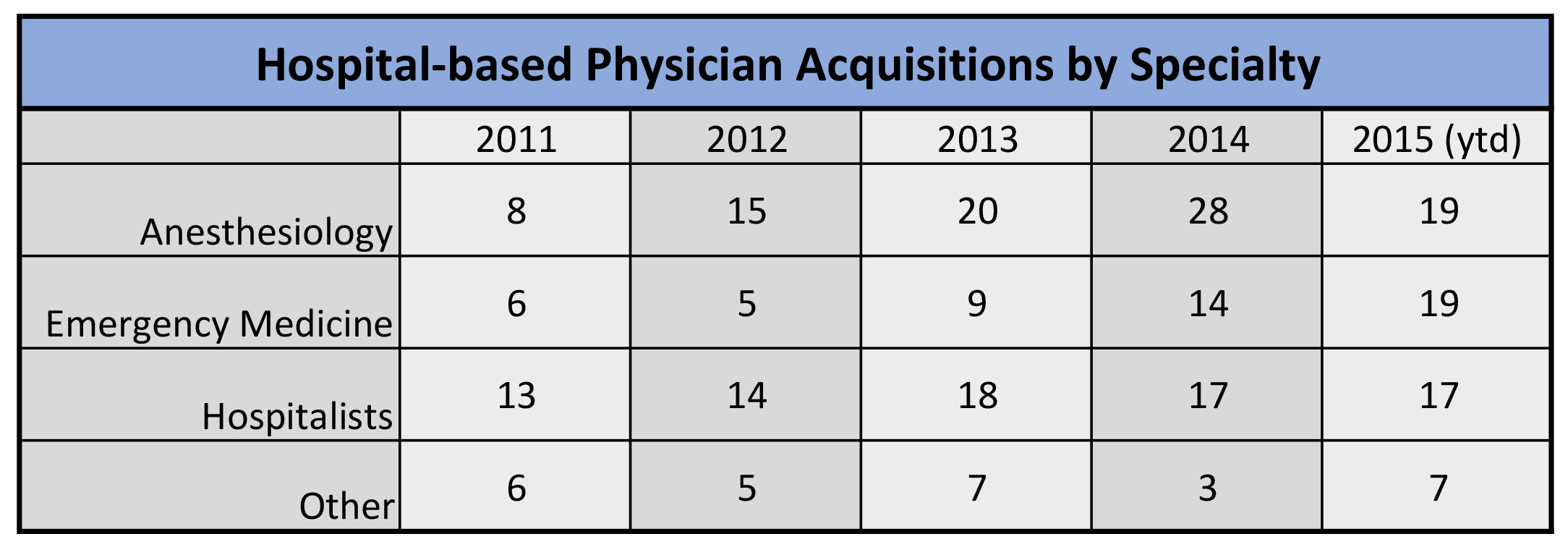

It is fair to say that pathologists are very independent, relative to other physician specialties. Data from Edgemont Capital Partners indicates that the number of annual HBP acquisitions nearly doubled between 2011 and 2015.

Most acquisitions involved anesthesiology, emergency medicine, and hospitalist groups.

However, other specialties, including pathology labs, show resistance to this resurgence in PPMC popularity comprising only 11% of the total acquisition groups in 2015.

What Drives the Rebirth of Physician Practice Management Companies?

One big factor in the newfound popularity of PPMCs are recent reforms to healthcare and implementation of the Affordable Care Act (ACA). A presentation by McDermott, Will & Emery (MWE) cites increased demand for services, changes in pay differentials, payment bundling, and the push to form Accountable Care Organizations (ACOs) as factors that motivate physicians to sell their groups to a PPMC.

In a recent interview with Modern Healthcare, Robert Frantz, MD, FACEP, president of TeamHealth Emergency Medicine’s West Group in Moore, Okla., highlighted the urgent nature of these challenges. He stated, “Medicine is transforming right now, and [physicians] don’t have a lot of time for a learning curve.”

Robert R. Frantz, MD, FACEP, President of TeamHealth Emergency Medicine West Group, told Modern Healthcare that “the handwriting was on the wall” in 2010. That’s when Morningstar Emergency Physicians of Oklahoma City, the physicians group Frantz belonged to at that time, sold its ED staffing practice to TeamHealth. (Photo copyright: TeamHealth.)

A list of PPMC value propositions from Becker’s Hospital Review further emphasizes these points. Leading factors in their list include:

• increased ability to make capital investments;

• reduction in administrative tasks; and

• a greater range of patient acquisition options.

Added to that list are additional needs, such as funding implementation of electronic health record (EHR) systems and meaningful use attestation, handling managed care and hospital contract negotiations, and optimizing risk management. These are among the reasons why PPMCs find that—by selling value instead of profits—hospital-based physicians and other medical professionals are ready to talk.

Challenges Facing PPMCs to Avoid Repeating the Past

With the burst of the last PPM bubble 15 years, ago, many medical professionals still recall the problems with that business model. That is why it is essential that the new wave of PPMCs find ways to differentiate their methods and benefits from those of the past.

Ostrow, Reisen, Berk & Abrams believes that it will require more than a shift in value propositions to build stability for PPMCs. It says, “[PPMCs and physicians excelling] can happen only through a business model that encourages physician engagement and aligns incentives between them and the company. The challenge here is to ensure that the physicians stay connected to the local practice while simultaneously supporting the overall interests of the larger entity.”

HealthLeaders Media (HLM) compiled a list of opportunities for physician groups that should ensure the success of the latest wave of acquisitions. HLM’s list includes:

1. Controlling and profiting from the revenue streams;

2. Improving revenue streams through demonstrated quality;

3. Development and commercialization of protocols;

4. Disease management;

5. Clinical trials and genetic testing;

6. Pharma economics;

7. Developing and operating employer clinics; and

8. Developing enhanced ancillary services.

As the latest trends on PPMCs continue to mature and stabilize, pathology groups and other specialist groups will need to evaluate the benefits and make tough decisions. While historically, these groups have opted out of similar business arrangements, the ability to offset the increased administrative, financial, and compliance-related tasks of modern healthcare reforms might prove tempting enough to encourage more physicians to sell their medical group to a physician practice management company.

—Jon Stone

Related Information:

Return of Physician Practice Management Companies

Is it Time to Resurrect Physician Practice Management Organizations?

Herding Hospital Docs: Staffing Firms Buy MD Groups