Hospital outpatient revenue is catching up to inpatient revenue, according to data released from the American Hospital Association (AHA). This increase is part of a growing trend to reduce healthcare costs by treating patients outside of hospital settings. It’s a trend that is supported by the White House and Medicare and continues to impact clinical laboratories, which serve both hospital inpatient and outpatient customers.

The AHA published this study data in its annual Hospital Statistics, 2019 Edition. The data comes from a 2017 survey of 5,262 US hospitals. The report includes data about utilization, revenue, expenses, and other indicators for 2017, as well as historical data.

The AHA statistics on outpatient revenue suggest providers nationwide are working to keep people out of more expensive hospital settings. Hospitals, like medical laboratories, appear to be succeeding at developing outpatient and outreach services that generate needed operating revenue.

This aligns with Medicare’s push to make healthcare more accessible through outpatient settings, such as urgent care clinics and physician’s offices. A growing trend Dark Daily has covered extensively.

Outpatient Revenue Climbs

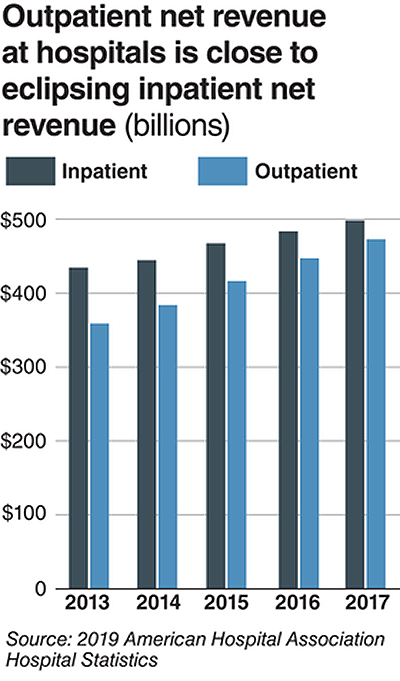

In its coverage of the AHA’s study, Modern Healthcare reported that 2017 hospital net inpatient revenue was $498 billion and net outpatient revenue was $472 billion.

The Becker’s Hospital CFO Report notes that gross inpatient revenue in 2017 was $92.7 billion higher than gross outpatient revenue. But in 2016, gross inpatient revenue was much further ahead—$129.5 billion more than gross outpatient revenue. The “divide” between inpatient and outpatient revenue is narrowing, Becker’s reports.

The graphic above illustrates the shrinking gap between hospital inpatient and outpatient revenues. “Outpatient revenue will ultimately eclipse inpatient revenue,” Chuck Alsdurf, Director of Healthcare Finance Policy and Operational Initiatives at the Healthcare Financial Management Association (HFMA), told Modern Healthcare. (Graphic copyright: Modern Healthcare/AHA.)

The Becker’s report also stated:

- Admissions increased by less than 1% to 34.3 million in 2017, up from 34 million in 2016;

- Inpatient days were flat at 186.2 million;

- Outpatient visits rose by 1.2% to 766 million in 2017; and,

- Outpatient revenue increased 5.7% between 2016 and 2017.

Similar Study Offers Additional Insight into 2018 Outpatient Revenue

A benchmarking report by Crowe, a public accounting, consulting, and technology firm, which analyzed data from 622 hospitals for the period January through September of 2017 and 2018, showed the following, as reported by RevCycleIntelligence:

- Inpatient volume was up 0.6% in 2018 and gross revenue per case grew by 5.3%;

- Outpatient services rose 2.4% in 2018 and gross revenue per case was up 7.1%.

Physicians’ Offices Have Lower Prices for Some Hospital Outpatient Services

Everything, however, is relative. When certain healthcare services traditionally rendered in physician’s offices are rendered, instead, in hospital outpatient settings, the numbers tell a different story.

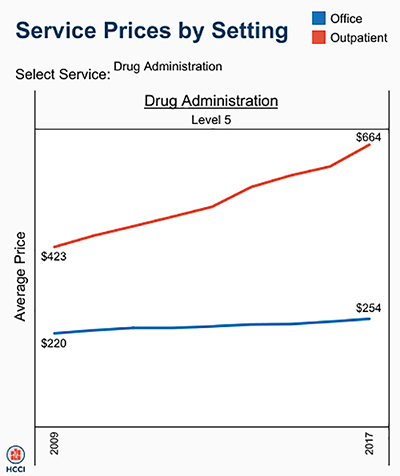

In fact, according to the Health Care Cost Institute (HCCI), the price for services was “always higher” when performed in an outpatient setting, as compared to doctor’s offices.

HCCI analyzed services at outpatient facilities as well as those appropriate to freestanding physician offices. They found the following differences in 2017 prices:

- Diagnostic and screening ultrasound: $241 in physician’s office—$650 in hospital outpatient setting;

- Level 5 drug administration: $254 in office—$664 in hospital outpatient setting;

- Upper airway endoscopy: $527 in office—$2,679 in hospital outpatient setting.

One example where hospital outpatient settings provide similar services at increased costs is in drug administration, as the graphic above illustrates. “The difference was higher than I expected. With some services, the price is two or three times higher when rendered in the outpatient setting,” Julie Reiff, HCCI researcher and report author, told Fierce Healthcare. (Graphic copyright: HCCI.)

Medicare Proposed Rule Would Change How Hospital Outpatient Clinics Get Paid

Meanwhile, the Centers for Medicare and Medicaid Services (CMS) has released its final rule (CMS-1695-FC), which make changes to Medicare’s hospital outpatient prospective payment and ambulatory surgical center payment systems and quality reporting programs.

In a news release, CMS stated that it “is moving toward site neutral payments for clinic visits (which are essentially check-ups with a clinician). Clinic visits are the most common service billed under the OPPS [Medicare’s Hospital Outpatient Prospective Payment System). Currently, CMS often pays more for the same type of clinic visit in the hospital outpatient setting than in the physician office setting.”

“CMS is also proposing to close a potential loophole through which providers are billing patients more for visits in hospital outpatient departments when they create new service lines,” the news release states.

Hospitals are fighting the policy change through a lawsuit, Fierce Healthcare reported.

In summary, clinical laboratories based in hospitals and health systems are in the outpatient as well as inpatient business. Medical laboratory tests contribute to growth in outpatient revenue, and physician offices compete with clinical laboratories for some outpatient tests and procedures. Thus, a new site-neutral CMS payment policy could affect the payments hospitals receive for clinic visits by Medicare patients.

—Donna Marie Pocius

Related Information:

AHA Data Show Hospitals’ Outpatient Revenue Nearing Inpatient

Hospitals’ Outpatient Revenue Inching Closer to Inpatient Revenue

“My Net Revenue is Stable,” said No CFO Ever . . .

Revenue Unable Despite Outpatient Volume Growth

From Physician Offices to Outpatient Settings and Costs Go Up, HCCI Study Finds

CMS Empowers Patients and Ensures Site Neutral Payment Proposed Rule –