Negative margins, a shift to nontraditional care sites, and an increasingly complex logistics environment should prompt clinical labs and anatomic pathology groups to quickly evaluate shipping costs and data analysis

In September, American Hospital Association (AHA) leaders and Kaufman Hall healthcare analysts posted a particularly dismal status update for US hospitals, saying more than half are projected to operate in negative margins for the rest of the year.

As a result, hospital and healthcare leaders are likely facing difficult decisions around traditional operations while actively seeking new partnerships to increase reach and impact of their hospital services, including clinical lab and pathology testing.

Market pressures and revenue opportunities, including nontraditional clinical trial designs, hospital-at-home programs, and innovative care management for patient cohorts, are reshaping healthcare around the US. These and other ensuing shifts will add complexity on top of already burgeoning costs to the physical logistics of clinical laboratory testing and pathology services.

Traditional and Nontraditional: Conduct Assessments of Lab Shipping Costs and Logistics Management

Analyzing data of dynamic logistical inputs will support informed service line decision-making and can ultimately lead to cost savings for clinical labs and health systems, according to Jeff Ledbetter, regional consultant for Cardinal Health OptiFreight Logistics. Ledbetter monitors cost-per-shipment models and trends in service modes for a variety of healthcare providers, networks, and reference laboratories.

“What I’ve seen in the marketplace is that labs have historically built a reliance on physician offices across the country,” Ledbetter explained in an interview with Dark Daily. “What is changing is that labs have diversified their client base and who they now consider customers.” Some of the new inputs include individual consumers, corporations, and schools, in addition to integrated delivery networks (IDNs) and IDN-like entities.

For Dark Daily, regional consultant for Cardinal Health Jeff Ledbetter explained three data trends guiding cost-saving clinical laboratory logistics strategies and benchmarking. These will be important as labs diversify their client base and who they now consider customers. (Photo copyright: Jeff Ledbetter.)

The problem, Ledbetter said, is that lab executives are not able to see the profitability of their customer types and cannot achieve operational efficiencies because of the more complex and dynamic inbound and outbound shipment flow.

Ledbetter describes three ways to analyze lab costs:

1. Cost-per-pack benchmarking,

2. Ratio of test kit outflow to inflow, and

3. Visibility to shipments for workflow management and staffing availability.

With multiple transportation components for each test performed, “a hidden cost element is wasted test kits,” Ledbetter said. “We look at the ratio of specimens sent out but not returned to the lab. Each lab kit passes through multiple modes of transportation. Kits that are deployed but not returned to the lab become waste, resulting in sunken cost. When I talk to reference lab leaders, they understand this is an issue, but they don’t know how to manage it.” Ledbetter points to OptiFreight Logistics’ robust analytics as a critical element to help manage the waste. To increase profitability, the lab can adjust to whom and how it deploys kits to optimize the number of kits with specimens that return to the lab for testing.

A related issue is understanding the ratio of outflow to inflow for identifying profitability of customers. “Managing customers is now shaped by data points such as productive and profitable pickups,” Ledbetter said. For example, a returned shipment with five specimens is more profitable than a shipment with only one specimen.

“We also look at efficiencies that consider the number of lab employees needed to accession specimens, and how delivery timing can maximize efficiency of the testing operation,” Ledbetter said. “This is based on the mode of service and available delivery time.”

The starting point, Ledbetter said, is to gain continuous data-driven insights into the best possible service modes and specimen pack timing that will improve the lab’s operational efficiency, ease staffing constraints, and correlate with business-critical key performance indicators. Amid an ongoing shift to nontraditional care sites, this level of visibility is critical, he added.

Aggressive Adoption of Decentralized Clinical Trial Services Expected

Following a Clinical Operations Roundtable, global management consulting firm McKinsey and Company explored the acceleration of decentralized clinical trials post-pandemic. Experts there define that model as a clinical trial centered around patient needs that improves the patient experience. By design, decentralized clinical trials will use one or more “decentralization elements” based on suitability for their end points, patient populations, and treatments.

“Clinical-trial sponsors creating hybrid protocols are drawing from the menu of decentralization services and technology interventions, such as remote monitoring of vitals, mobile clinics, and home visits,” wrote Life Sciences Practice leader Gaurav Agrawal and others for the McKinsey and Company report, “No Place Like Home? Stepping Up the Decentralization of Clinical Trials.”

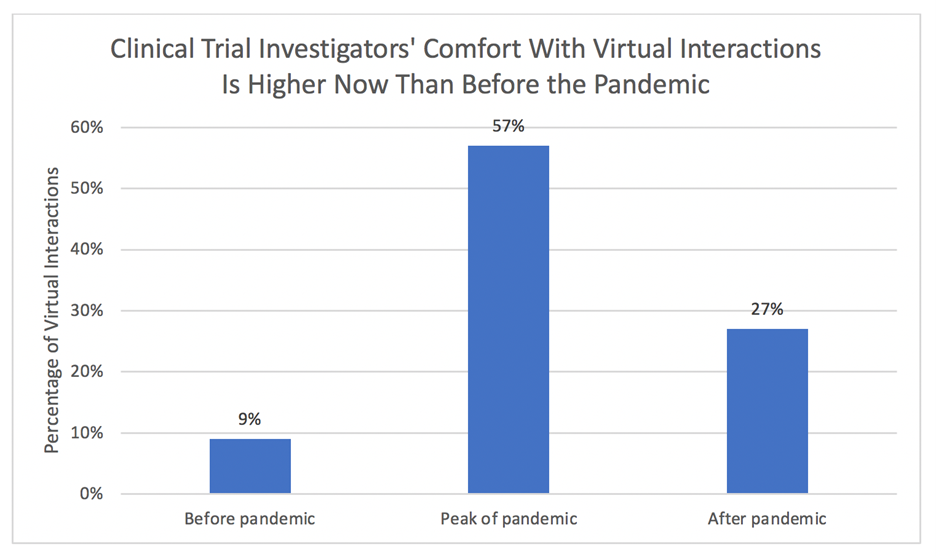

“Traditional site visits will still be needed for complex procedures and specialized assessments, such as screenings and magnetic resonance imaging. So smart, hybrid trial designs will make other touchpoints virtual or closer to the patients—for instance, through mobile clinics and primary-care physicians—whenever possible,” states the McKinsey report. The graphic below shows potential trends that will be of interest to hospital and IDN executives, clinical laboratory leaders, and anatomic pathology group administrators.

According to McKinsey and Company research, clinical trial investigators anticipate a threefold increase in remote patient interactions compared to before the pandemic, although that comfort level is lower than during the peak of the pandemic. (Source: McKinsey and Company and Nature Reviews Drug Discovery.)

Since specific laboratory tests mark key points within the care continuum, decentralization creates a more dynamic environment for specimen logistics, making visibility, data analytics, and predictive technology around lab deliveries essential for maximum profitability.

Hospital at Home and Moving Lab to Home

As the healthcare industry shifts to the home as a site of care, legacy patient-provider relationships and business will face disruption, executives at The Chartis Group wrote in a blog post published in September.

“Health systems would do well to consider how they are positioned to deliver care at home as an integrated part of their care models,” Chartis wrote in its blog. “This may include evaluating legacy home health assets and programs, while also rapidly evaluating the business case for launching a hospital-at-home program as part of their broader strategic and operational plans.”

Although outpatient services have taken to the flavor of innovation, hospital-at-home models may not be easy. “Simply extending the reach of hospitals into patients’ homes is unlikely to allow the promising scale or cost savings stakeholders hope for from home hospitalization programs,” according to a recent Health Affairs piece that simplifies many of the issues, such as top-down and bottom-up payment approaches and transformation challenges of which include diagnostics, monitoring, pharmaceuticals, and nursing services among many.

Regardless, changes to hospital operations in the coming year may be inevitable as a result of cost and payer pressures. In the meantime, patient cohorts appear to be a starting point for moving lab to home and potentially stopping the bleeding.

In Arizona, Sonora Quest Laboratories announced an “exclusive service” that is targeted to those living with chronic conditions and cognitive decline. Collaborating with remote healthcare service provider Getlabs in Los Angeles (for blood sample collection services) and Raleigh, NC-based uMETHOD (a precision medicine care plan provider), the service provides on-demand home lab collection, diagnostics, and individualized assessments to help slow early-stage progression of cognitive decline.

The Sonora Quest-Getlabs-uMethod triad is just one example of mobile and remote clinical laboratory services at work in various parts of the country, as The Dark Report recently explained. In a pilot trial of at-home phlebotomy services, laboratory order completion rates for patients jumped up 22.5%—this is significant because many factors can lead patients to discontinue lab orders, such a driving distances, time wasted sitting in a lab’s waiting room, or the inability to travel.

All of these moves describe strategic actions healthcare providers are taking to make existing and new services more accessible and possibly more efficient. Demand for shifting from traditional to nontraditional sites for care will continue to confront clinical labs and anatomic pathology groups with both opportunities and dilemmas. Forward-looking hospital, health system, and reference lab leaders will leverage logistics technologies.

—Liz Carey

This article was produced in collaboration with Cardinal Health OptiFreight Logistics. For more information, visit www.cardinalhealth.com/optifreight or email gmb-optifreight@cardinalhealth.com.

Related Information:

No Place Like Home? Stepping Up the Decentralization of Clinical Trials

CVS Acquisition of Signify Health Highlights the Rapid Move to Healthcare at Home

Hospital At Home Is Not Just For Hospitals

Telemedicine Firms Offer Home Phlebotomy Service