What It Means to Be a Clinical Laboratory Whistleblower Outlined in Newly Released ‘Tell-All’ Book by Lab Executive Chris Riedel

Book provides detailed road map for clinical laboratory professionals who believe they have a valid case to file under the federal qui tam statute, as well as lab owners who want to understand what motivates whistleblowers and what practices to avoid

Several high-profile whistleblower cases uncovering massive fraud have shocked the clinical laboratory industry over the past decade. Media coverage nearly always focuses on the court battle and subsequent renderings of justice. But little is written about what it is like to be a whistleblower who wants to hold a medical laboratory accountable for alleged violations of federal and state laws.

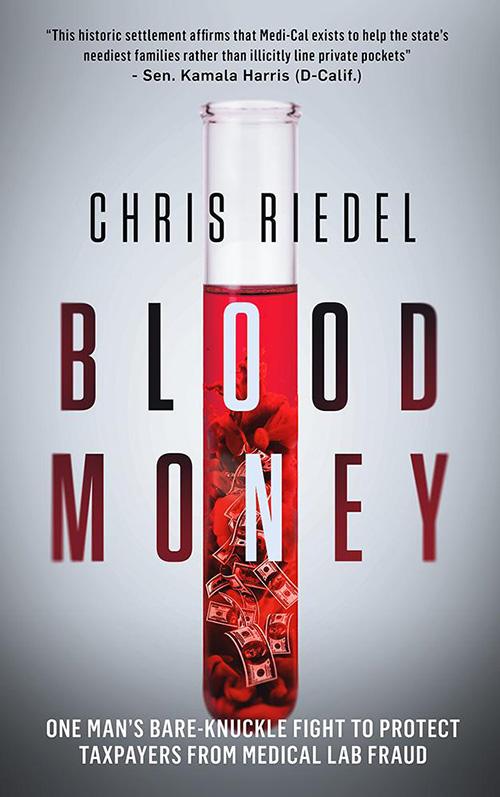

Now, a new “tell-all” book penned by Chris Riedel, a whistleblower who owned a clinical laboratory company in California, details the exploits of clinical laboratory whistleblowers over the past 15 years. The intriguing white-collar crime thriller, titled, “Blood Money: One Man’s Bare-Knuckle Fight to Protect Taxpayers from Medical Fraud,” outlines Riedel’s battle with major clinical laboratory players—including the so-called “Blood Brothers” Labcorp (NYSE:LH) and Quest Diagnostics (NYSE:DGX)—to expose medical laboratory fraud.

‘Most Whistleblowers Get Absolutely Destroyed’

The book takes the reader on a gripping journey into extortion, money laundering, attempted murder, buried gold in a CEO’s backyard, fraudsters hiding money in the Cayman Islands, and, according to the author, an Assistant Attorney General sabotaging her own state’s case and a corrupt state Governor who undermined litigation by his own Attorney General.

“I wrote it to be a true crime thriller, so I’m hoping people who love thrillers will enjoy it as a true crime story,” Riedel said in an exclusive interview with Dark Daily. “For anyone who’s considering filing a whistleblower lawsuit, this is an absolute must read.

“Most whistleblowers get absolutely destroyed,” he explained. “When companies find out who’s trying to attack their business model, they do everything they can to destroy the whistleblower’s life. Many end up bankrupt, unemployable, and divorced.

“There are things you can do to protect yourself and I list those in my rules for whistleblowers. I hope enough people will read it—particularly in Congress and maybe the Department of Justice (DOJ)—to put pressure on the DOJ to change their behavior. They are far too willing to accept what they call ‘affordable civil settlements’ as opposed to punishing companies and people for their theft,” Riedel said.

Chris Riedel (above) has worked in the healthcare industry as an executive and an entrepreneur for more than 40 years. He founded five companies, including two medical laboratories and a cardiovascular disease management company. For the past 15 years, he has been tirelessly working to fight against medical companies that are defrauding US taxpayers. His actions have resulted in a court verdict and settlements totaling more than $550 million. (Photo copyright: Leadership Books.)

Riedel became a whistleblower in 2005 when he filed a case under California law that was sealed until 2009. Jerry Brown, California Attorney General at that time, joined the case and unsealed it.

Riedel had acted after his sales representatives informed him that his company, Hunter Laboratories, needed to come up with a way to compete against larger labs’ pricing to survive. Knowing the test-price-discounting practices transpiring within the lab industry in California, Riedel determined he had three choices:

- Violate federal and state laws to compete,

- Close his business, which would cause him to lay off more than 150 employees and lose most of his life’s savings, or

- Try to stop the other companies from participating in fraudulent practices.

“It is very frustrating for honest CEOs of clinical labs to see that they cannot compete well against those lab companies employing fraudulent schemes. Rather than compete on the quality of service of their products as honest companies do, fraudsters compete based on the value of their illegal inducements,” he states on his website. “I felt the pain that many other honest CEO’s and lab owners have had to endure as they try to compete with fraud and watch their life’s work destroyed.”

He chose to try leveling the playing field for all labs and stop taxpayers from being fleeced. After filing that first whistleblower lawsuit in California in 2005, he later filed similar whistleblower lawsuits in other states that had statutes defining how labs were to price lab tests for their Medicaid programs.

Riedel encountered many roadblocks and frustrations during the initial lawsuit, including some genuinely frightening moments. He described one such experience for Dark Daily.

“Quest and Labcorp together went to Blue Shield of California, a major insurance company, and they got our clinical lab kicked out of network. They offered Blue Shield a 10% discount on all their laboratory testing if they would kick Hunter Laboratories out of network,” Riedel explained. “Since [Quest and Labcorp] represented about 70% to 80% of the total outpatient laboratory testing for Blue Shield, it was too good for this insurer to pass up.

“When your lab loses a major insurance carrier like that, you can’t survive. What doctor is going to want to start with a clinical lab that doesn’t have Blue Shield? And existing clients don’t want to subject their patients to having much higher out-of-pocket expenses.

“From that point on, it was like a dagger in our heart,” he added. “We were literally two weeks away from both corporate and personal bankruptcy when we reached our historic settlement with Quest. Had it not been for that settlement, our 150 employees would have lost their jobs, we would have lost our house, and we would have been completely bankrupt. That was very scary, and I had a very hard time dealing with it.”

Uncovering Medical Laboratory Fraud

While performing his research for the whistleblower case, Riedel was astonished by the information and fraud he discovered.

“There was one point where we had to prove that Quest and Labcorp were passing out discounts to some clients that were at or below cost, without giving those same prices to the Medi-Cal program, as required by state law at that time,” Riedel explained. “I personally reviewed over a million documents. It took more than five years, but it was worth it.

“I eventually found three documents that exposed the complete fraud by Quest. These documents showed what Quest had billed Medi-Cal, how much money the company lost client billing and capitation contracts, and how much business they ‘pulled through’ from the government and insurance payers that made up for the staggering losses on deeply discounted client and capitated billing. That was like the silver bullet.”

In the process, Riedel also discovered what it was like to work with the federal Department of Justice.

“The DOJ hates people who file more than one whistleblower lawsuit,” he added. “They don’t like the statute to begin with, and they barely tolerate whistleblowers, so when they find someone who does it time and again, they really don’t like it.”

“Blood Money” (above) contains practical advice and suggestions that are useful for both clinical laboratory executives and pathologists who want to keep their lab operations compliant with federal law, thus not giving whistleblowers any issues to pursue a qui tam lawsuit, as well as lab whistleblowers who observe violations within their clinical labs—or at competing labs—and who want to do something that may rectify the situation. (Photo copyright: Chris Riedel.)

Riedel is considering writing a second book and is trying to decide which qui tam lawsuits will provide the best subject matter.

“I am currently investigating what would be a multi-billion-dollar lawsuit against an insurance company and that is going to be, by far, the biggest of the cases I have ever been involved in. That might make a good book all by itself,” he said.

Riedel finds his work fighting fraud against the government rewarding and plans to continue his efforts in the future.

“Even though it’s risky—and the book details how my life was almost destroyed when the Blood Brothers counter attacked—I enjoy the investigative work and legal challenges. For me, it is very fulfilling, and I am proud to carry the torch for taxpayers,” he says in a statement on his website.

The 368-page book should be of interest to clinical laboratory personnel, healthcare professionals, those considering becoming a whistleblower, and basically anyone involved in medical laboratory testing.

—JP Schlingman

Related Information

An Interview with Whistleblower and Author, Chris Riedel

Chris Riedel Massive Health Care Fraud and the Importance of Whistleblowing

Health Diagnostic Laboratory Files for Bankruptcy after Settlement with Government