Jun 25, 2018 | Compliance, Legal, and Malpractice, Laboratory Management and Operations, Laboratory News, Laboratory Operations, Laboratory Pathology, Laboratory Testing, Management & Operations, Webinars

Operational efficiencies, strong management teams, and successful outreach business are key clinical laboratory success in today’s era of mergers and acquisitions

Fierce economic headwinds are taking aim at the entire pathology industry, as shrinking Medicare reimbursement rates, shifting federal regulations and compliance requirements, and changing care models squeeze profit margins and threaten valuations of most clinical laboratories and anatomic pathology groups.

The reimbursement rate changes mandated by the Protecting Access to Medicare Act of 2014 (PAMA), which took place January 1, 2018, loom as the most immediate danger to the long-term financial health and viability of medical diagnostic laboratories.

“Medicare reimbursement rates to labs providing essential testing services are estimated to drop by $670 million this year, and additional reductions scheduled for 2019 and 2020 will cut payments by nearly 30% for many tests critical to caring for Medicare beneficiaries,” noted Julie Khani, President of the American Clinical Laboratory Association (ACLA), in “Patient Care Is Put to the Test as Clinical Laboratory Services Are Hit With a One-Two Punch in Rate Cuts,” an article she penned for the ACLA website.

“For some labs, such as rural hospitals and labs serving patients in skilled nursing facilities—which already have significantly higher operating costs—this could be a death knell that would precede a devastating loss of patient access to necessary testing services,” she concluded.

Assessing Financial Solvency to Survive Impending Mergers and Acquisitions

The ACLA has filed a lawsuit against the U.S. Department of Health and Human Services (HHS) for what it called a “flawed and misguided” implementation of the law. For now, however, the roll out of reimbursement rates cuts will continue, an ACLA blog post reports.

As a result, post-PAMA pressures combined with other factors are forcing clinical laboratory leaders to consider their strategic options, including:

- Reorganizing;

- Restructuring;

- Merging/consolidating with another laboratory; and,

- Selling.

As GenomeWeb pointed out prior to PAMA’s implementation, “All clinical labs in the U.S.—from the largest reference labs to in-hospital labs to physician-practice labs—will be touched by the changes to varying degrees.” The future, GenomeWeb predicts, “may be a market with fewer independently operated small and regional labs, as well as fewer outreach labs owned by hospitals. Instead, such operations could become part of [Quest Diagnostics’] and LabCorp’s networks.”

This changing landscape means laboratories need to be assessing their financial solvency and maximizing their valuation even if they are not currently candidates for either side of the merger and acquisition equation. Failing to anticipate and respond to unfolding changes could leave laboratory executives courting a financial reckoning.

Pathway to Driving Valuation for Your Laboratory

To help clinical laboratory owners, CEOs, administrators, and pathologists understand the forces driving today’s mergers, acquisitions, and joint ventures—and to guide their future decision-making—Dark Daily is presenting a new webinar at 1:30 p.m. EASTERN on Thursday, June 28, 2018, titled, “The Pathway to Driving Valuation for Your Laboratory: Your Roadmap to Achieving Success, and How to Sustain Growth Despite a Changing Lab Environment.”

One speaker is Vicki DiFrancesco, Chief Strategy Officer, XIFIN, San Diego. DiFrancesco has an insider’s understanding of mergers and acquisitions and 25 years of executive leadership experience. Prior to joining XIFIN, DiFrancesco served as President and CEO of Pathology Inc., the West Coast’s premier women’s health laboratory, which was acquired by LabCorp in March 2016.

The other speaker is David Nichols, Founder and President at Nichols Management Group (NMG) in York Harbor, Maine. NMG provides laboratory consulting services for healthcare organizations. Since its founding in 1988, NMG has provided expertise in improving overall effectiveness and in implementing such strategies as sales force development, market planning, compliance/financial auditing, and in selected cases, hands-on management responsibilities by working onsite with senior personnel in each area of need.

During their 90-minute presentation, you will learn:

- Market factors creating financial challenges for your laboratory;

- How revenue compression and compliance issues are driving merger and acquisition activity;

- Steps to optimizing your lab’s reimbursements, a key to improving financial performance;

- Revenue cycle management’s importance as a valuation driver;

- Strategies to significantly improve your market position;

- Components of an effective compliance program and why compliance is so important to laboratory valuation;

- Value drivers that attract buyers, such as profitable growth, a strong compliance program, competent management teams, EBITDA, cash flow and gross margins; and,

- Specific challenges that should be addressed in any merger or consolidation plan.

David Nichols (left), Founder and President at Nichols Management Group (NMG); and Vicki DiFrancesco, Chief Strategy Officer, XIFIN, will share vital insights and share critical strategies that clinical laboratories can immediately use to drive valuations and prepare for current and future financial challenges. (Photo copyright: Dark Daily.)

To register for this critical webinar, use this link (or copy and paste this URL into your browser: https://www.darkdaily.com/product/the-pathway-to-driving-valuation-for-your-laboratory-your-roadmap-to-achieving-success-and-how-to-sustain-growth-despite-a-changing-lab-environment/.)

Despite the financial pressure on many existing laboratories, the medical laboratory industry continues to play a vital role in the healthcare system, with clinical laboratory tests guiding more than 70% of all medical decisions made by healthcare providers, according an ACLA fact sheet.

The industry also contributes more than $100 billion in annual economic impact and produces more than 622,400 jobs. While the role of diagnostic laboratories will continue to grow in an era of personalized medicine, only laboratories that optimize their strategic position in response to the changes taking place may be left standing when the predicted industry consolidation is complete.

—Andrea Downing Peck

Related Information:

The Pathway to Driving Valuation for Your Laboratory: Your Roadmap to Achieving Success, and How to Sustain Growth Despite a Changing Lab Environment

Patient Care Is Put to the Test as Clinical Laboratory Services Are Hit with a One-Two Punch in Rate Cuts

ACLA PAMA Lawsuit Complaint Against CMS

Recent NILA Report Highlights Harmful Impacts of Misguided PAMA Implementation on Labs and Seniors

The PAMA Effect: Consolidation of Clinical Labs Expected as Legislation Set to Take Effect

Conference Ends with Optimistic Outlook for Laboratories

Clinical Laboratory Testing: Life Saving Medicine Starts Here

Jun 22, 2018 | Laboratory Management and Operations, Laboratory News, Laboratory Operations, Laboratory Pathology, Laboratory Testing, Managed Care Contracts & Payer Reimbursement, Management & Operations, Webinars

As PAMA brings estimated Medicare reimbursement cuts of up to 30% over the next three years to a range of typically high-volume tests and diagnostics, medical laboratories that wish to stay competitive must understand the needs of managed care payers and learn how to optimize collections, reduce denials, and communicate value effectively or risk their financial health

In what experts have called the biggest financial upheaval for the healthcare industry in three decades, the onset of new Medicare Part B Clinical Laboratory Fee Schedule (CLFS) reductions based on the Protecting Access to Medicare Act (PAMA)—and their continued decrease over coming years—places the financial integrity of clinical laboratories and anatomic pathology groups of all sizes in peril.

Recent years have seen major shifts in consolidation, automation, and efficiency analysis to help streamline both workflows and cashflows. However, the threat from the current and coming cuts to Medicare lab test prices will be particularly acute for smaller independent laboratories and hospital/health system lab outreach programs. These labs will continue to feel added strain due to reduced reimbursement across 25 of the most common tests billed to Medicare.

The Centers for Medicare and Medicaid Services (CMS) and the Office of the Inspector General (OIG) predict that the cuts enacted on January 1, 2018, alone will result in Medicare payments to labs falling by a total of $670 million just in 2018. This amount is almost 70% greater than the $400 million in fee cuts the federal agency had predicted in statements it published last year. (See Dark Daily, “For Top 20 Tests, CMS to Cut Payment by 28% in 2018-2020,” October 9, 2017.)

And, that doesn’t account for subsequent cuts, which are estimated to reach nearly 30% over the next three years.

Cost of Service Disparities/In-Network Status Further Impact Clinical Labs

If the CLFS reductions weren’t enough, labs face another threat—managed care and commercial payers aligning with big national laboratories and narrowing networks in an attempt to lower costs and provide maximum return for both patients and shareholders. For smaller and independent laboratories, this represents a double threat.

In the first situation, larger laboratories can offer services at lower costs due to increased automation, batch processing, and other scale advantages. This means that while the lower CLFS rates will impact the financial integrity of larger labs, the actual margin lost is less than that of smaller laboratories and facilities that face higher costs to perform tests and provide services.

Compounding the situation, commercial and managed care payers searching out the best value for their patients and shareholders tend to narrow their networks by excluding many independent clinical lab companies and hospital lab outreach programs, amplifying this inherent disparity and skewing the advantage away from independent providers yet again.

Higher cost providers without a clear understanding of promoting their value to payers could have trouble obtaining in-network status. Yet, failing to obtain in-network status may reduce overall test quantities, further raise prices, and make smaller labs less competitive with larger national laboratories—a dangerous cycle with today’s competitive laboratory landscape.

Shifting Focus and Optimizing Managed Care Reimbursements

As the financial stability of Medicare reimbursements wanes, it is imperative that laboratories look to new methods to further increase efficiency and stabilize cashflows. Once a smaller portion of laboratory revenue, managed care organizations and commercial payers will be of increased importance as overall reimbursement rates continue to shrink in the face of healthcare reform and value-based care.

Unfortunately, many laboratories assume that by simply providing requested services they are due reimbursement from commercial payers. In the age of value-based care this is no longer the case and considered an outdated mindset—one that can lead to endless audits, increased recoupment costs, and which could drastically impact successful collection from managed care and commercial payers. (See Dark Daily, “Payers Hit Medical Laboratories with More and Tougher Audits: Why Even Highly-Compliant Clinical Labs and Pathology Groups Are at Risk of Unexpected Recoupment Demands,” October 16, 2015.)

Special June 26 Webinar: Improving Managed Care Reimbursement Efficiency

Understanding not just what these payers are attempting to achieve for their organization—but also how they structure requirements and processes to support their goals—is an essential element of succeeding in this previously smaller share of the marketplace.

For those interested in learning more about critical concerns regarding managed care payers in the post-2018 CLFS landscape, Pathology Webinars is hosting a 90-minute webinar on Tuesday, June 26, 2018, at 2:00 PM Eastern.

The webinar will include presentations from two experts on a range of topics including:

- Actionable steps to absorb the loss of Medicare revenue due to the impact of the 2018 CLFS reductions;

- How managed care payers process network status and payments;

- Who in the managed care chain of command should receive your value proposition;

- How to better align your value propositions, policies, and workflows with the requirements of managed care and commercial payers; and,

- Understanding the roles managed care payers expect clinical laboratories and anatomic pathologists to play in managing and reducing unnecessary testing.

The first speaker, Frank Dookie, MBA, will provide an inside look at:

- How managed care payers function;

- Their requirements and workflows; and,

- What they look for when considering network status for a laboratory.

Dookie is a laboratory professional who has worked on the payer side for 28 years. He is passionate about the role that diagnostics play or can play in healthcare, and has spent his career working for instrumentation providers, clinical laboratories, the intermediary space between laboratories and managed care companies, and managed care companies.

The second speaker, Michael Snyder, will bring the entire payment process into sharp focus. He will cover:

- Optimizing the collection process;

- Identifying the purpose of each step, each review, and each team member involved; and,

- Critical points laboratories must address to ensure payment.

Snyder is the Senior Vice President of Network Operations for Avalon Healthcare Solutions, LLC, a firm that provides comprehensive benefit management services to the health plan industry and has more than 30 years’ experience in clinical laboratory management.

Frank R. Dookie, MBA (left), Contracting Executive with a major managed care company in Woodbridge, N.J.; and Michael Snyder (right), Senior Vice President with Avalon Healthcare Solutions in Flemington, N.J., will provide critical insights and actionable details for clinical laboratory and anatomic pathology group leaders who want to ensure future revenues.

An Essential Opportunity to Improve Your Reimbursements

This critical webinar offers anatomic pathology groups and medical laboratory managers essential information and actionable next steps to immediately leverage the potential of managed care payers. Additionally, it provides insider insight to laboratories straining to retain financial integrity as reduced reimbursements and increased regulatory burdens strain budgets and cashflows.

To register for the webinar and see further details about discussion topics, use this link (or copy and paste the URL into your browser: https://pathologywebinars.com/current/managed-care-an-insiders-guide-to-improving-your-reimbursement-efficiency-with-strategies-that-work-626/).

As further Medicare payment reductions over the next three years drive reimbursements even lower, understanding how to capture the positive attention of payers—while working within the rules and policies driving their reimbursement decisions—will be an essential element of successful laboratory management and growth. Register now!

—Jon Stone

Related Information:

Continued ‘Aggressive Audit Tactics’ by Private Payers and Government Regulators Following 2018 Medicare Part B Price Cuts Will Strain Profitability of Clinical Laboratories, Pathology Groups

Payers Hit Medical Laboratories with More and Tougher Audits: Why Even Highly-Compliant Clinical Labs and Pathology Groups Are at Risk of Unexpected Recoupment Demands

Tougher Lab Regulations and New Legal Issues in 2018: More Frequent Payer Audits, Problems with Contract Sales Reps, Increased Liability for CLIA Lab Directors, Proficiency Testing Violations, and More

Coming PAMA Price Cuts to Medicare Clinical Lab Fees Expected to Be Heavy Financial Blow to Hospital Laboratory Outreach Programs

What Every Lab Needs to Know about the Medicare Part B Clinical Laboratory Price Cuts That Take Effect in Just 157 Days, on Jan. 1, 2018

Medicare Clinical Laboratory Price Cuts and Cost-cutting Predicted to be 2018’s Two Biggest Trends for Medical Laboratories in the United States

Apr 25, 2018 | Instruments & Equipment, Laboratory Instruments & Laboratory Equipment, Laboratory Management and Operations, Laboratory News, Laboratory Operations, Laboratory Pathology, Management & Operations

Direct-to-consumer medical laboratory testing company gets a major shot in the arm as developers find ready investors and increasing consumer demand

Clinical laboratory tests, usually performed without fanfare, were thrust into the limelight during a recent episode of Shark Tank, an American reality TV show on which aspiring entrepreneurs compete for the attention and partnership funds of various investors.

EverlyWell, a direct-to-consumer (DTC) company that offers at-home lab tests without lab visits or doctor referrals, obtained a $1-million line of credit from Lori Greiner, one of Shark Tank’s participating entrepreneurs, according to MobiHealthNews. EverlyWell has consumers collect their own specimens at home, which are then sent to a medical laboratory testing facility.

Based in Austin, Texas, EverlyWell was founded in 2015 by Julia Taylor Cheek, CEO, with an aim to “make lab tests accessible, simple, and meaningful,” according to a news release. Cheek is also a Venture Partner with NextGen Venture Partners and formerly the Director of Strategy and Operations with the George W. Bush Institute.

“It’s incredible for the industry that we were selected and aired on a show like Shark Tank. It really shows the intersection of what’s happening in consumer healthcare and the high cost in healthcare and that people are really responding to new solutions,” Cheek told MobiHealthNews.

“I think the product is brilliantly crafted,” Greiner stated during the episode’s taping, according to MobiHealthNews. “It’s really nice; it’s really easy. It’s super clear. I think the state of healthcare in our country now is so precarious. I think this gives people an empowered way … to know whether or not they have to go find a doctor,” she concluded.

Greiner offered the $1 million line of credit (with 8% interest) in exchange for a 5% equity stake in EverlyWell, explained Austin360. According to SiliconHillsNews, she did so after reviewing certain EverlyWell financial indicators, including:

- $2.5 million in revenue in 2016;

- $5 million expected revenue in 2017; and

- 20% monthly growth rate.

Julia Cheek, CEO and Founder of EverlyWell (above), in a news release following her success on reality show Shark Tank, said, “We’re leading a major shift in the consumer health marketplace by bringing the lab to consumers’ doorsteps, and we are moving quickly to expand our channels, launch innovative tests, and deliver a world-class customer experience.” (Photo copyright: Forbes/Whitney Martin.)

Physician Review Still Part of Home-testing Process

EverlyWell lists 22 home lab tests on its website and a market share that encompasses 46 states. Shoppers can search for specific tests based on symptoms or by test categories that include:

- General Wellness;

- Men’s Health;

- Women’s Health;

- Energy and Weight; and

- Genomic Test (through a partnership with Helix, a personal genomics company).

The most popular test panels include:

- Food sensitivity;

- Thyroid;

- Metabolism;

- Vitamin D; and,

- Inflammation.

Prices range from $59 for a glycated hemoglobin (HbA1c) test (found under the general wellness category) to $399 for a women’s health testing kit. EverlyWell explains that it has no insurance contracts for these diagnostic tests, which do not require office or lab visits.

The testing process, according to EverlyWell’s website, proceeds as follows:

- After ordering and paying online, kits arrive at the customer’s home;

- The consumer self-collects a sample (such as blood spots, dried urine, or saliva) and returns it by prepaid mail to a medical laboratory that partners with EverlyWell. The company notes that it works with CLIA (Clinical Laboratory Improvement Amendment)-certified laboratories;

- A board-certified doctor reviews the lab results; and,

- A report is available online in a few days.

“Our goal is not to remove the importance of physician review. It’s to make the experience easier for the consumer,” Cheek told Texas CEO Magazine. “We designed a platform that is all about access and empowering consumers to have access to and monitor their own health information,” she continued.

Texas CEO Magazine explained that Cheek was inspired to create the company following “a bad personal experience with health and wellness testing that sent her to seven different specialists, cost $2,000 out of pocket, and left her with pages of unreadable results.”

Since then, the three-year old start-up company has garnered more than $5 million in venture capital, noted the news release.

Many Choices in Direct-to-Consumer Lab Company Market

EverlyWell is not the only player in the DTC clinical laboratory test space. According to MedCityNews, there are at least 20 other DTC lab test companies in the market including:

- 23andMe;

- Laboratory Corporation of America (LabCorp);

- Mapmygenome;

- Pathway Genomics;

- Quest Diagnostics (Quest);

- Sonora Quest Labs;

- Theranos; and others.

The direct-to-consumer lab test market grew from $15 million to about $150 million in 2015 and includes both large and small clinical laboratory test developers, noted Kalorama Information.

Clearly, the DTC testing market is expanding and garnering the attention of major developers and investors alike. This growing demand for home-testing diagnostics could impact anatomic pathology groups and smaller clinical laboratories in the form of reduced order testing and decreased revenue.

—Donna Marie Pocius

Related Information:

Mail-Order Lab Test Startup EverlyWell Makes Million Dollar Deal on ABC’s Shark Tank

EverlyWell Raises Additional Capital, Bringing Total to $5 Million

This Austin Entrepreneur Scored Historic Deal on Shark Tank

Austin-based EverlyWell Lands Deal on Shark Tank

Innovative Texas Businesses: Empowering Consumers; Julia Cheek’s EverlyWell’s Health and Wellness Testing

Meet the Start-up Revolutionizing the Lab Testing Industry

20 Key Payers in the Direct-to-Consumer Lab Testing Market

Direct-to-Consumer Services Put Down Roots in US Lab Testing Market

Clinical Pathology Laboratories Should Expect More Direct-to-Consumer Testing

Sales of Direct-to-Consumer Clinical Laboratory Genetic Tests Soar, as Members of Congress Debate How Patient Data Should be Handled, Secured, and Kept Private

Jan 26, 2018 | Instruments & Equipment, Laboratory Instruments & Laboratory Equipment, Laboratory Management and Operations, Laboratory News, Laboratory Operations, Laboratory Pathology, Laboratory Sales and Marketing, Laboratory Testing, Management & Operations

Lack of Medicare or third-party payer coverage for most genetic screening tests in healthy adults is not discouraging development of new gene testing products

With the global anatomic pathology genetic testing market poised to reach $9.8 billion by 2025, clinical laboratories continue to develop new genetic screening tests (rather than diagnostic tests) intended to help physicians identify patients who carry inherited genetic mutations that could put them or their future children at higher risk for chronic disease, such as cancer.

This is a bit of a gamble since (with some exceptions) Medicare and many health insurers typically will not pay for predictive and presymptomatic genetic tests and services used to detect an undiagnosed disease or disease predisposition.

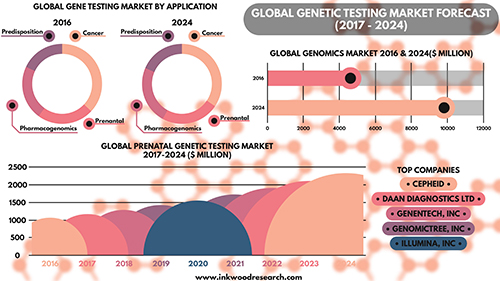

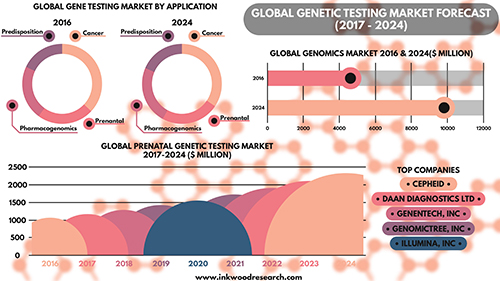

Nevertheless, Inkwood Research of Gurugram, India, predicts in its “Global Genetic Testing Market Forecast 2017-2024” report that aging populations throughout the world will be the driving force producing “enormous opportunities for the global genetic testing market.” The research firm anticipates this will result in a 9.93% increase in annual sales revenue during each of the next seven years.

Screening versus Diagnostic Testing Gains Popularity Among Patients, Physicians

Genetic diagnostic testing promises to accelerate the growth of precision medicine by guiding the diagnosis and treatment of cancer and other chronic diseases. However, genetic tests that “screen” healthy patients for predispositions to certain diseases also are gaining traction in the marketplace.

The US Food and Drug Administration (FDA) gave direct-to-consumer genetic screening testing a boost in April 2017 when it allowed marketing of 23andMe Personal Genome Service Genetic Health Risk tests for 10 inherited diseases or conditions, including:

· Parkinson’s Disease;

· Late-onset Alzheimer’s Disease;

· Celiac Disease; and

· other conditions.

“Consumers can now have direct access to certain genetic risk information,” Jeffrey Shuren, MD, Director of the FDA’s Center for Devices and Radiological Health, said in a press release. “But it is important that people understand that genetic risk is just one piece of the bigger puzzle, it does not mean they will or won’t ultimately develop a disease.”

Robert Green, MD, MPH, a Professor of Medicine at Harvard Medical School, told NPR that consumers should have access to genetic information. However, they also need to understand its limitations.

“Some people really want this [genetic] information on their own, and others want it through their physician,” Green said. “Both those channels are legitimate. People should just be aware that this information is complicated.”

According to the Inkwood Research report, “The global genetic testing market is anticipated to grow from $4,614 million in 2016 to $9,806 million by 2025, at a CAGR [Compound Annual Growth Rate] of 9.93% between 2017 and 2025. The important driver increasing growth in the global genetic testing market is an aging population on the rise. The rising geriatric population is driving the global genetic testing market to a significant level.” (Caption and graphic copyright: Inkwood Research.)

· Cystic Fibrosis;

· Sickle Cell Disease; and

· Spinal Muscular Atrophy.

The genetic screening panel tests for the 22 heritable diseases cited by the American College of Obstetricians and Gynecologists (ACOG) in a Committee Opinion on genetic carrier screenings published by the ACOG in March 2017.

“The United States is truly a melting pot, and it no longer makes sense for physicians to assume genetic screening is appropriate for an individual based on presumed race or ethnicity,” Felicitas Lacbawan, MD, Executive Medical Director, Advanced Diagnostics, Quest Diagnostics, stated in a press release. “QHerit is designed for any woman and her partner, not just those in a specific, so-called high-risk ethnic or racial group.”

Genetic Screening in Primary Care Helps Assess Risk for Chronic Disease

Genetic diagnostic test developer Invitae (NYSE:NVTA) also points to growing evidence of the genetic screening test’s value to healthy individuals. In September 2017, Invitae presented initial findings at the National Society of Genetic Counselors 36th Annual Conference. The study showed a retrospective analysis of 120 patients tested with a proactive genetic screening panel for healthy adults had revealed medically significant findings for nearly one in five patients.

“Interest among otherwise healthy adults in using genetic information to understand their risk of disease conditions continues to grow each year, ” Robert Nussbaum, MD, Chief Medical Officer of Invitae, said in a press release. “These and other data show that interest is well-placed, with a substantial group of patients showing genetic variants associated with elevated risk of diseases like cancer where monitoring and early intervention can be helpful. Use of genetic screening in the primary care setting can assess risk to help shape individual screening plans. We are continually adding tools and resources that help reduce barriers to the widespread use of genetic information in mainstream medical practice.”

Routine Genetic Screening Could Become Norm, CDC Says

The Centers for Disease Control and Prevention (CDC) notes that newborn screening is “currently the largest public health genetics program in the world,” with more than four million babies screened at birth each year for 30 or more genetic conditions. In the CDC’s “Genomics and Health Impact Blog,” the agency continues to maintain a “cautionary attitude about personal genomic tests” beyond the newborn period, directing those considering direct-to-consumer laboratory testing, such as 23andMe and MyMedLab, to “think before you spit.”

Nonetheless, the CDC acknowledges routine genetic screening of healthy people could become the norm. However, others advise caution.

“To be sure, while the use of genome sequencing is promising in certain clinical scenarios, such as rare diseases and cancer, we do not think that whole genome sequencing in the general population is appropriate at this time,” Muin J. Khoury, PhD, MD, Director, Office of Public Health Genomics, CDC, wrote in a January 30, 2017, blog post. “We would not recommend its use outside research studies … But it is also becoming clearer that as science progresses, we are discovering more opportunities for using genetic screening of healthy individuals for preventing common diseases across the lifespan, outside of the newborn screening context.”

The impact on clinical laboratories and anatomic pathology groups should genetic screening become normalized should be clear: Labs will be tasked with performing these tests, and pathologists will be needed to interpret them and educate both physicians and patients on the findings.

Before that, however, genetic screening tests will need to be fully supported by government, and insurers, including Medicare, will have to agree to pay for them.

—Andrea Downing Peck

Related Information:

Global Genetic Testing Market Forecast 2017-2024

Carrier Screening for Genetic Conditions

Quest Diagnostics Launches QHerit, a Pan-Ethnic Genetic Screening Panel Aligned with New Medical Guidelines

Invitae Expands Test Menu for Proactive Genetic Testing in Healthy Adults

Invitae Highlighting New Research, Expanded Suite of Services at National Society of Genetic Counselors (NSGC) 36th Annual Conference

Consumer Genetic Testing: Think Before You Spit, 2017 Edition

Genetic Screening of Healthy Populations to Save Lives and Prevent Disease

FDA Allows Marketing of First Direct-to-Consumer Test that Provide Genetic Risk Information for Certain Conditions

FDA Approves Marketing of Consumer Genetic Tests for Some Conditions

Dec 12, 2017 | Compliance, Legal, and Malpractice, Laboratory Management and Operations, Laboratory News, Laboratory Operations, Laboratory Pathology, Laboratory Testing, Management & Operations, News From Dark Daily

In filing Monday, lawsuit seeks to force HHS to comply with PAMA’s statutory requirements and to withhold applying the new Clinical Laboratory Fee Schedule until HHS has revised the final rule appropriately

Many clinical laboratory executives will welcome the news that a lab industry trade association has filed a lawsuit in federal court in an effort to delay and fix the final rule for Protecting Access to Medicare Act of 2014 (PAMA) private payer lab test market price reporting that Medicare officials used to lower prices on the Medicare Part B Clinical Laboratory Fee Schedule (CLFS) that is scheduled to take effect on Jan. 1, 2018.

In a lawsuit filed Monday, the American Clinical Laboratory Association (ACLA) charged that the federal Department of Health and Human Services (HHS) ignored congressional intent and instituted a highly-flawed data reporting process when setting the 2018 CLFS rates under the Protecting Access to Medicare Act of 2014.

The ACLA asked the US District Court for the District of Columbia to force HHS to comply with PAMA’s statutory requirements, to withhold applying the new CLFS until HHS has revised the final rule appropriately. The CLFS is due to take effect on Jan. 1.

The lawsuit also seeks to vacate any actions that HHS made that were not in accordance with the PAMA law and to withdraw or suspend the final rule under PAMA. The case is American Clinical Laboratory Association v. Hargan, US District Court, District of Columbia, No. 1:17-cv-2645.

Final Prices for the 2018 Part B Clinical Laboratory Fee Schedule

Last month, the federal Centers for Medicare and Medicaid Services (CMS) issued the final CLFS rates and said at the time that it did so in compliance with the 2016 final rule implementing changes to the Medicare clinical laboratory fee schedule under PAMA section 216.

“We have repeatedly advised CMS that there are significant, substantive deficiencies in the final rule, which fail to follow the specific commands of the PAMA statute,” said ACLA President Julie Khani in an ACLA press release. “Contrary to Congress’ intent, instead of reforming Medicare reimbursement rates to reflect the broad scope of the laboratory market, the Secretary’s final rule will disrupt the market and prevent beneficiaries from having access to the essential laboratory services they need.”

Shown above is Julie Khani, President of the American Clinical Laboratory Association (ACLA) speaking at the Executive War College on Laboratory and Pathology Management last May in New Orleans. In a press release announcing ACLA’s lawsuit against the Department of Health and Human Services, Khani emphasized that many clinical laboratories had advised officials at the federal Centers for Medicare and Medicaid Services (CMS) about the “significant, substantive deficiencies in the final rule” for private payer market price reported that CMS designed. (Photo copyright: The Dark Report.)

22 Healthcare Organizations Opposed Cuts to Clinical Laboratory Test Prices

The ACLA, the American Hospital Association (AHA), and more than 20 other organizations had urged CMS to suspend implementation of the new CLFS rates, which are scheduled to take effect Jan. 1. The organizations cited concerns over the data-collection process used to establish the rates, and the fact that the rates would cause clinical laboratories to struggle financially and possibly close. If the rates set under PAMA affect Medicare beneficiaries’ access to clinical lab testing, the law would have the opposite effect of its intent.

To bring the lawsuit, ACLA retained Mark D. Polston, JD, of the Washington, DC, law firm of King and Spaulding. A specialist in representing healthcare systems seeking to navigate Medicare regulations, Polston is the former Chief Litigation counsel for CMS and specializes in complicated Medicare reimbursement litigation. Recently, he successfully challenged Medicare’s so-called “two-midnight” rule that imposed a 0.2% rate cut on hospitals billing for some patients.

Medicare Program Prohibited Most Medical Laboratories from Reporting

Contrary to Congress’ directives, most laboratories were prohibited from reporting private payer data under CMS’ market-rate data-collection process, ACLA said in a prepared statement. “As a result, CMS failed to protect access to laboratory services for Medicare beneficiaries. This flawed process could cause serious financial harm to potentially thousands of hospitals, independent and physician office laboratories, and make it harder for Medicare beneficiaries to get access to medical testing, particularly in remote rural areas and in nursing homes that depend on laboratory testing services,” ACLA said.

In the lawsuit, ACLA alleged that more than 99.3% of hospitals were prohibited from reporting their market-rate data. It is believed that this is the first time this figure has been reported. In 2015, the lawsuit charged, more than 261,500 entities received Medicare payment for laboratory services but only 1,942 laboratories reported market-rate information in 2016 under the PAMA final rule. The 1,942 labs that reported market-rate data is about 0.7% of the total number of laboratories that serve Medicare beneficiaries, the lawsuit said.

Only 21 of 7,000 Hospital Laboratories Reported Data

“Moreover, contrary to Congress’ intent, the laboratories that did report information are not representative of the market as a whole,” the lawsuit added. “For example, although approximately 7,000 hospital laboratories billed Medicare for laboratory services in 2015—accounting for 24% of the Medicare payments made under the Clinical Laboratory Fee Schedule—no more than 21 hospital laboratories (and probably even fewer) reported information to the secretary, leaving hospital laboratories effectively unrepresented in the data collected by the secretary.

“Hospital laboratories are often the only laboratories available to patients in certain areas of the country, and the private payer rates they receive are often much higher than other laboratories, due to differences in competitive markets, volumes of services, and other factors,” the lawsuit charged.

The Dark Report, Dark Daily’s sister publication, provided a compelling example of the serious flaws in the market price study conducted by CMS. Writing about the state of Michigan, The Dark Report noted: “At Joint Venture Hospital Laboratory Network (JVHL), CEO John Kolozsvary said Michigan’s hospitals serve 70% of the office-based physicians in the state with outreach lab testing services. Included among these hospitals are the 120 JVHL member laboratory facilities.”

“Since our network, plus the outreach programs of another 25 or 30 hospitals, hold a significant share of outreach lab testing in Michigan, how can CMS conduct an accurate, representative market study of what private insurers pay for lab tests in Michigan if it doesn’t collect data on what private payers reimburse hospital lab outreach programs in Michigan?” stated Kolozsvary in his interview with The Dark Report.

Did CMS ‘Disregard and Violate’ PAMA Statute?

In the ACLA’s announcement of the lawsuit, Polston said, “CMS clearly disregarded and violated the statute’s specific, unambiguous directives requiring commercial rate information to be reported and collected from a broad, diverse group of market participants. Instead, information was collected from less than 1% of US laboratories.”

In the press announcement, ACLA Board Chair Curt Hanson, MD, Chief Medical Officer of Mayo Medical Laboratories said, “This lawsuit reflects our obligation to those who are providing critical testing services, and to those millions of Americans who rely on the services our industry provides.” Others supporting the lawsuit include Laboratory Corporation of America and Quest Diagnostics.

Compliance with PAMA Law’s Statutory Requirements

In the lawsuit, ACLA seeks to require HHS to comply with the statutory requirements and to set aside the provisions in the final rule, “that unlawfully exempts thousands of laboratories from the reporting obligations that Congress imposed” under PAMA. A central feature of PAMA Section 216 is that laboratories must report market rate data so that HHS can ensure that Medicare reimbursement rates closely reflect the rates laboratories receive from private payers, the lawsuit said.

“ACLA was a strong supporter of Congress’ market-based reforms, which resulted in the most extensive changes to the system for reimbursing clinical laboratories since 1984,” the lawsuit said.

In challenging the final regulations, the lawsuit said HHS disregarded and violated, “the statute’s specific, unambiguous directives requiring that all applicable laboratories report relevant data.”

Congress Specified Which Medical Laboratories Are Obligated to Report

“In imposing these requirements, Congress took care to specify which laboratories would be obligated to report market data to ensure that information would be collected from a broad, diverse group of market participants,” the lawsuit said. “Congress made clear that any ‘laboratory’ would be required to report data if, ‘with respect to its revenues under [the Medicare program], a majority of such revenues are from’ the Physician Fee Schedule or the Clinical Laboratory Fee Schedule,” the lawsuit charged.

In promulgating the regulations, however, HHS, disregarded Congress’ instructions and “unreasonably and arbitrarily exempted significant categories and large numbers of laboratories that meet the statutory definition from the reporting requirements that Congress imposed,” the lawsuit said.

“The secretary’s final rule fatally undermines one of PAMA’s purposes, which is to require a broad spectrum of Medicare-participating laboratories to report market information to the secretary. Instead, in ultra vires (Latin for “beyond the powers”) fashion, the secretary has carved out large categories of laboratories—ultimately resulting in the exclusion of some 99.3% of the laboratory market—from the statutory reporting requirements,” the lawsuit charged. Ultra vires acts fall outside the authority of the organization in question.

In the lawsuit, the ACLA claims under:

count 1: ultra vires agency action not in accordance with law, in excess of statutory authority;

count 2: unreasonable construction of statute;

count 3: violation of the Administrative Procedure Act, arbitrary and capricious action; and,

count 4: violation of the Administrative Procedure Act, injunctive and declaratory relief.

Seeking an Injunction to Have HHS Secretary to Withhold or Suspend Final Rule

In its final section, “Prayer for Relief,” the lawsuit asks the court to vacate, “any agency action found to be arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law;” to require the Secretary of HHS to comply with the statutory requirements, “including faithfully implementing the statutory definition of ‘applicable laboratory;’” and enter an “injunction that (1) directs the Secretary to withdraw or suspend his final rule until such time as it can be brought into compliance with the statute, and (2) directs the Secretary to withhold applying the new Clinical Laboratory Fee Schedule until such time as the Secretary has made appropriate revisions to his final rule.” The lawsuit also asked the court to award to the ACLA “costs and disbursements of this action and reasonable attorneys’ fees.”

—Joseph Burns

Related Information:

ACLA Files Lawsuit Challenging PAMA Rates

CMS Ignored Congressional Intent in Implementing New Clinical Lab Payment System Under PAMA, ACLA Charges in Suit

Quest Diagnostics Supports Suit Against HHS Charging That CMS Ignored Congressional Intent in Implementing New Clinical Lab Payment System

LabCorp Supports American Clinical Laboratory Association Lawsuit on PAMA Final Rule

For Top 20 Tests, CMS to Cut Payment by 28% in 2018-2020; Medicare officials move one step closer to destroying beneficiary access to lab tests: The Dark Report, October 9, 2017